Taking too long? Close loading screen.

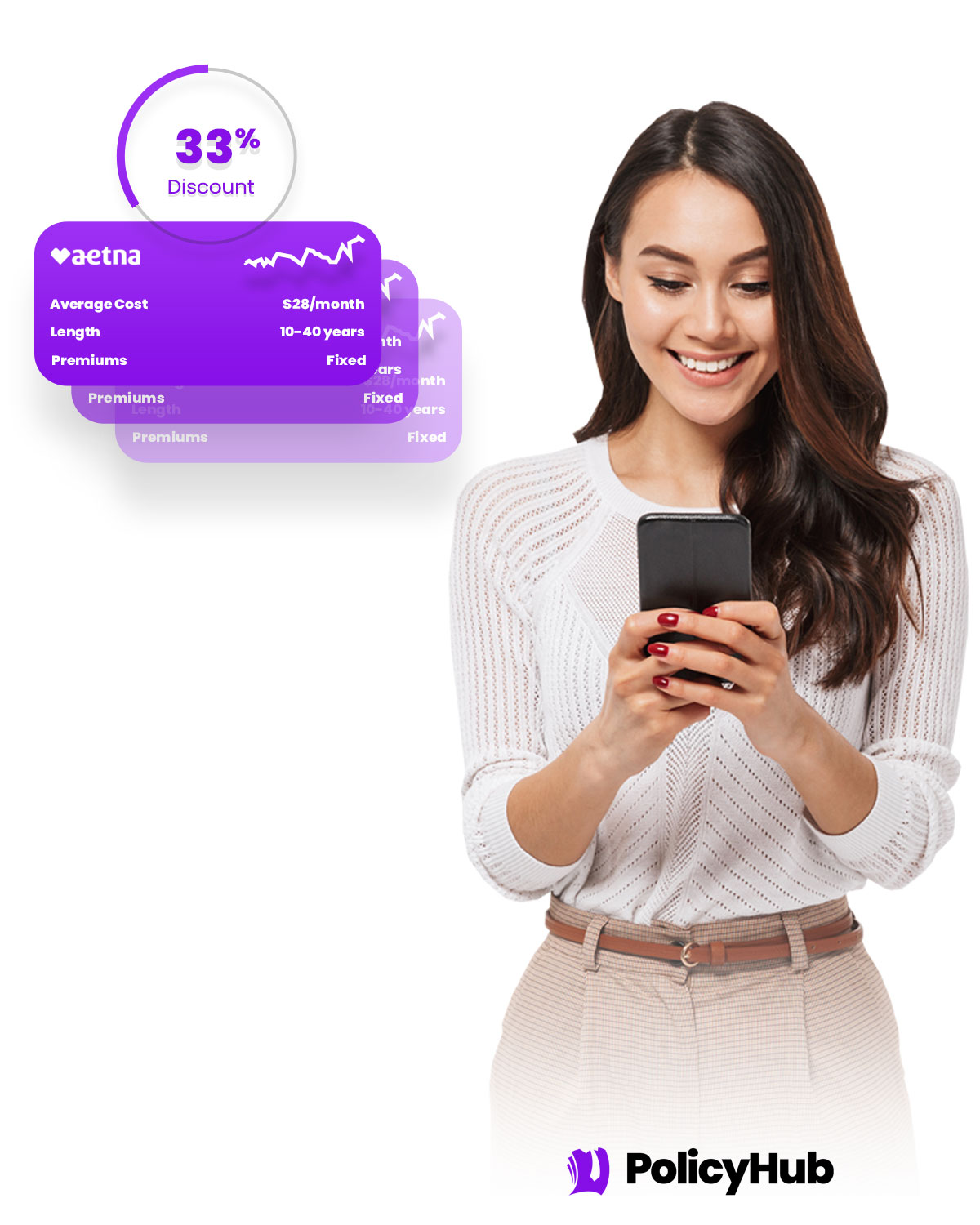

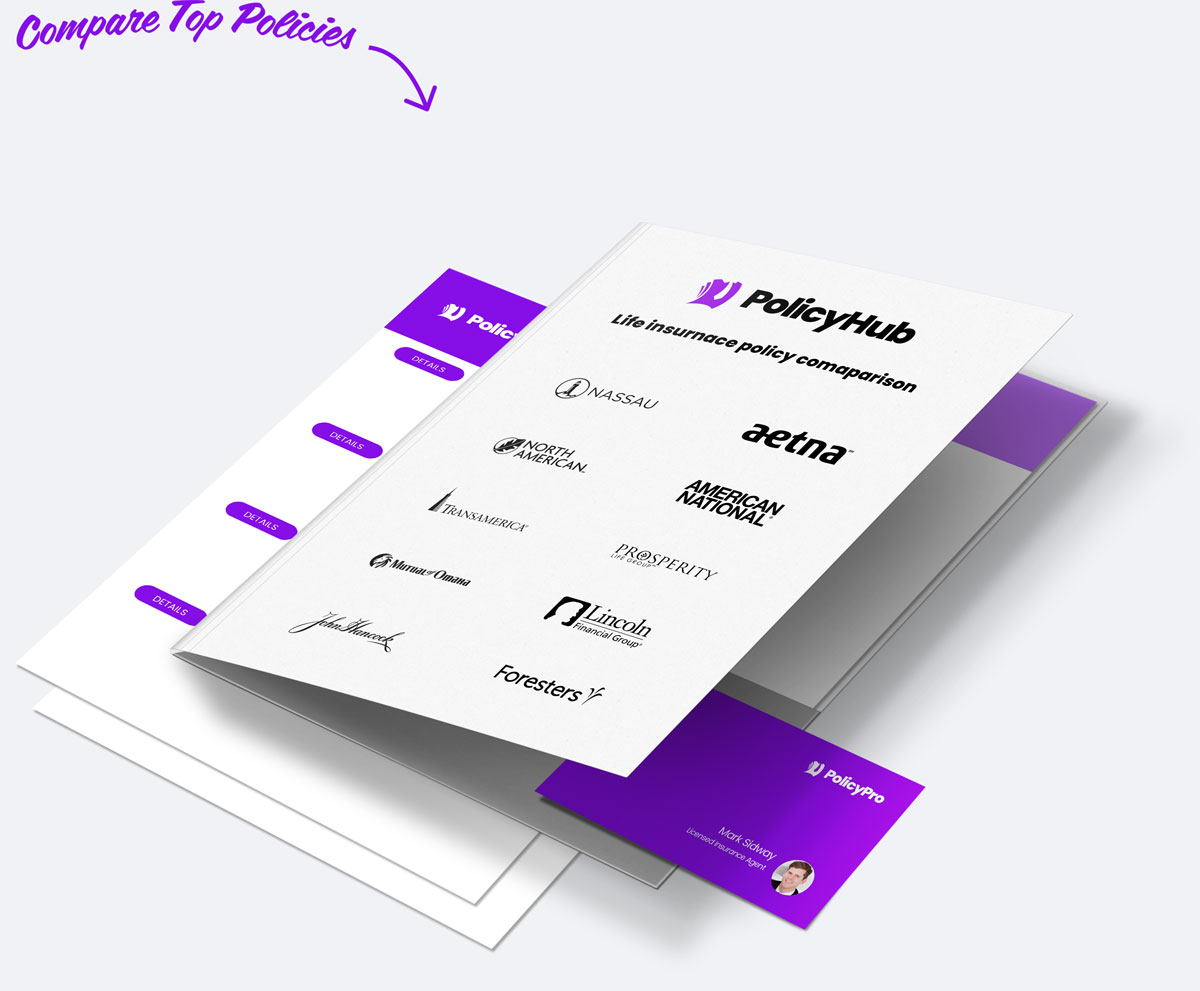

Compare over 20 life insurance policies in as little as 5 minutes.

With PolicyHub you get to compare over 20 life insurance policy providers in as little as 5 minutes. Save time. Save big. Get started now.

Compare over 20 top providers in Lake Oswego, OR

Your one-stop-shop to compare all the rates, all at once.

With PolicyHub you get:

Over 20 policy provider comparison.

Explore policies in Lake Oswego, OR from all the leading providers and choose the right one for you.

Locked in rate discount and exclusive deals.

Benefit from exclusive deals offered to residents in Lake Oswego, OR, and lock in rate discounts.

Customized policies just for you.

Our team tailors policies to Lake Oswego, OR residents, meaning optimal coverage at competitive rates.

"I was totally lost trying to find the right life insurance until I found PolicyHub. I was able to work with a licensed agent to compare all my options all at one. I got the perfect plan for me at a cheaper rate than I expected."

Barbara Winters

Policy Holder

ATTN: 2024 Lake Oswego, OR rates just released!

Get the latest insurance rates for 2024 and lock in your policy today! Get started comparing policies today.

Get the perfect plan with the cheapest rates in 3 easy steps.

Life insurance in Lake Oswego, OR Done in 3 easy steps

Step 1

Tell us about yourself.

Finding the perfect life insurance policy starts with answering a few questions to help us serve you better.

Step 2

Compare rates & plans with a pro.

Discuss your options with a licensed insurance agent. Compare different plans to find the best policy with the best rates.

Step 3

Lock in cheap rates.

Secure the lowest rates and lock in the perfect life insurance policy for you and your family.

"I lost hope trying to find a life insurance policy that wasn't insanely expensive. Thankfully PolicyHub helped me find the perfect policy that is affordable with high coverage. Thank you!"

Bill Barton

Policy Holder

PolicyHub is the smartest way to protect the people that matter most.

Safeguard Your Family

Life insurance means safeguarding your family in a worst-case scenario. Don't risk it.

Gain Peace of Mind

Far too many Americans are financially blindsided by the death of a loved one. But not your family.

Protect Your Business

Protect your business by ensuring a smooth transition of ownership with the right life insurance.

Beat Estate Taxes

Inheritance or estate taxes is burdensome for your heirs. A life insurance policy can help.

Invest in Your Future

For less than $1 per day, you can make a huge contribution to your family's financial safety.

Build Your Legacy

Through a life insurance policy, you can leave behind a legacy for your loved ones.

Get started in less than 5 minutes.

With PolicyHub getting started is easy. Compare all the rates from all the providers in Lake Oswego, OR. Get started in under 5 minutes.

All your life insurance needs in one place.

Term Life Insurance

Term insurance provides coverage for a set period of time, and it's a cost-efficient way to get the maximum coverage. It's an excellent solution for folks who have a temporary need for coverage.

Whole Life Insurance

Whole life insurance is coverage that lasts your entire life. This type of insurance also has a cash value component that grows over time, offering potential for financial growth along with lifelong coverage.

Universal Life Insurance

Universal life insurance is flexible coverage that lets you adjust your premiums and death benefits as your circumstances change throughout life. This flexibility makes it a popular choice.

No-Medical-Exam Life Insurance

No-medical-exam life insurance allows you to dodge the medical examination usually required for life insurance policies. It's perfect for individuals who want a swift approval process or have health concerns.

"Highly HIGHLY recommend PolicyHub if you need life insurance. They saved me sooo much time and money on my policy, it's nuts. Comparing all the providers at once is a game changer."

Chris Stephens

Policy Holder

Introducing PolicyHub Price Match Guarantee

Our priority is to save you money while getting you the right coverage. If you find a lower rate for a similar policy anywhere else, we'll match it! With PolicyHub, you can rest assured knowing you're getting the best price in Lake Oswego, OR.

Save time and get the best policy with the cheapest rates. Guaranteed.

|

Option 1 | Option 2 | ||

|---|---|---|---|---|

| 100% Digital | ||||

| Licensed Agents | ||||

| Expert Support | ||||

| Get Started in 5 Minutes | ||||

| Decades of Experience | ||||

| Compare 20+ Providers | ||||

| Zero Hidden Costs | ||||

| Top Insurance Providers |

"I knew I needed life insurance but I didn't know where to go. I talked with a few other companies but the cost was outrageous. I found PolicyHub and found the perfect plan for me at an affordable cost."

Wendy Smith

Policy Holder

Frequent Questions...

Life insurance provides financial security for loved ones in the event of an unexpected death. In a city like Lake Oswego, OR, which is routinely ranked as one of the best places to live in the United States, life insurance can ensure that the residents' families have the financial resources they need during a time of sorrow and emotional upheaval. Life insurance gives peace of mind to responsible adults, knowing that they can provide for their families even in the unexpected event of their passing. Moreover, life insurance policies are relatively affordable and flexible enough to adapt to changing circumstances.

Can life insurance policies be transferred or sold with life insurance companies in Lake Oswego?

Life insurance policies can't be sold or transferred; however, they can be replaced by new policies according to Oregon insurance regulations. In Lake Oswego, OR, many insurance companies provide information about this process and have the expertise to help individuals replace existing policies with new ones. For example, many agents are available in Lake Oswego to provide policyholders with advice and assistance to make sure they get the policy that best meets their current needs. Additionally, some insurers in Lake Oswego provide free initial consultations to review current coverage and determine the best options for replacing existing policies.

Can I buy more than one life insurance policy Lake Oswego?

Yes, you can purchase more than one life insurance policy in Lake Oswego, OR. Multiple policies can offer additional coverage that can provide your family with increased peace of mind. Buying more than one policy can help you customize your coverage based on your individual needs. For example, some policies may offer extra coverage for children, while others may offer additional coverage for a longer duration or more money when the policyholder dies. Shopping around for life insurance policies in Lake Oswego, OR is the best way to make sure you're getting the best coverage for your needs.

How does inflation impact my policy with life insurance near Lake Oswego?

Inflation can have a significant impact on the value of your life insurance policy in the Lake Oswego, OR area. With inflation, your insurer may increase the policy's premium to keep up with rising costs. In addition, as the value of the premiums receive decreases, the death benefit may not keep up with the cost of living. This could mean that any beneficiaries of your life insurance policy may not receive as much money as they may have originally anticipated.

Will a life insurance company Lake Oswego cover death from natural disasters?

Life insurance policies can vary, so it is important to read through a policy carefully to be aware of any coverage exclusions with regards to natural disasters in the Lake Oswego area. Generally, if death is a direct result of a natural disaster, most life insurance policies could provide a death benefit for the policyholder. It is also important to note that standard life insurance policies may include additional coverage for natural disaster related deaths, depending on the needs of the policyholder. Therefore, it is important to consult an insurance provider to assess a specific policy's coverage.

In Lake Oswego, OR, life insurance policies specify a primary beneficiary, and whenever that beneficiary passes away prior to the policyholder, the policy will pass to a secondary, or contingent, beneficiary. Or, if the insured has not named a successor beneficiary, the policy proceeds will be passed directly to the estate of the insured. This is an important factor to consider when living in a city like Lake Oswego, OR, and planning for the complete and sound financial future of those you love.

Do life insurance policies near Lake Oswego have any cash value?

In Lake Oswego, OR, many life insurance policies may come with a cash value component. This feature is designed to generate returns that can be used with your policy. With this, you can choose to surrender the policy or borrow against it. You can also use the cash value to pay for premiums, so the policy remains in force. It’s important to to speak with a licensed life insurance agent to determine if your policy has a cash value and how to best use it. You may likely find that it’s an invaluable piece of your financial security planning.

What does 'level term' mean regarding life insurance in Lake Oswego?

A "level term" in a life insurance policy is typically used to protect a family from the potential loss of income should a death occur. In Lake Oswego, OR a life insurance policy with level term can provide financial security to a family that has suddenly had their loved one taken away from them. This form of life insurance premium usually stays the same throughout the term of the policy, regardless of age or health changes. Depending on the policy, a level term life insurance policy may provide death benefits of a fixed amount, usually paid out to a predetermined beneficiary.

Can I buy a Lake Oswego life insurance policy for another person, like my spouse or parent?

Yes, you can purchase life insurance for another person, such as your spouse or parent, in the Lake Oswego, OR area. Insurance companies in Lake Oswego offer policies that allow for one person to be the primary policyholder and another to be the beneficiary. Depending on the company, you may be able to pay for the plan directly or you may arrange for premium payments to come out of a checking account in Lake Oswego or from an existing life insurance policy.

What should I look for in a Lake Oswego life insurance company?

If you're looking for a life insurance company located in Lake Oswego, OR, you should prioritize companies with good customer service, strong reputation, a wide range of products and services, and competitive rates. Transparency is also a key factor; you should look for a company that provides clear and comprehensive information on their policies and procedures and is honest and transparent in its dealings. You should read customer reviews as well as research the longevity and financial stability of the company in order to make the best decision for your life insurance needs.

Other locations near Lake Oswego, OR

Compare Life Insurance Policies

Get started today and compare over 37 life insurance providers in as little as 15 minutes.

© 2024 PolicyHub - all rights reserved