Taking too long? Close loading screen.

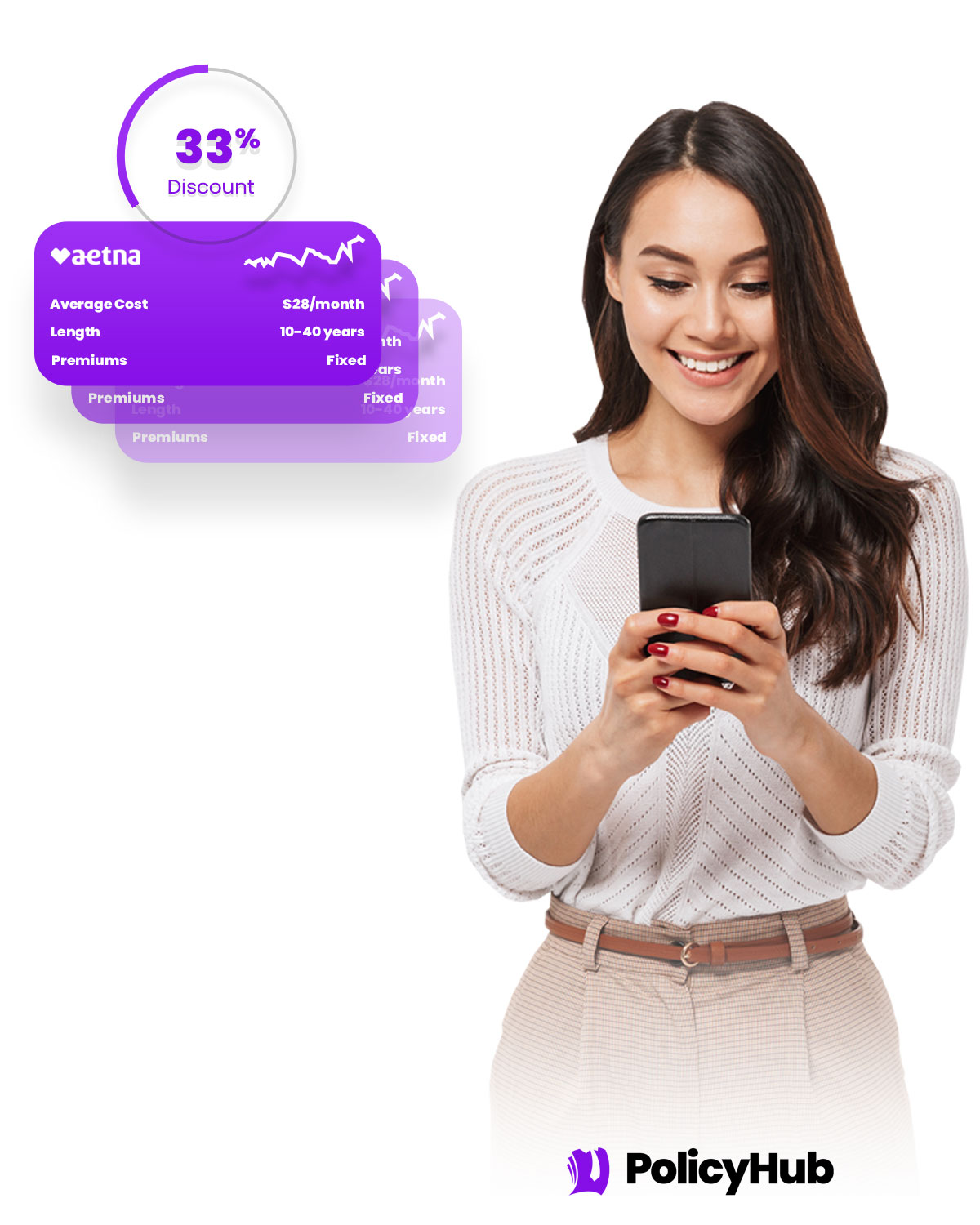

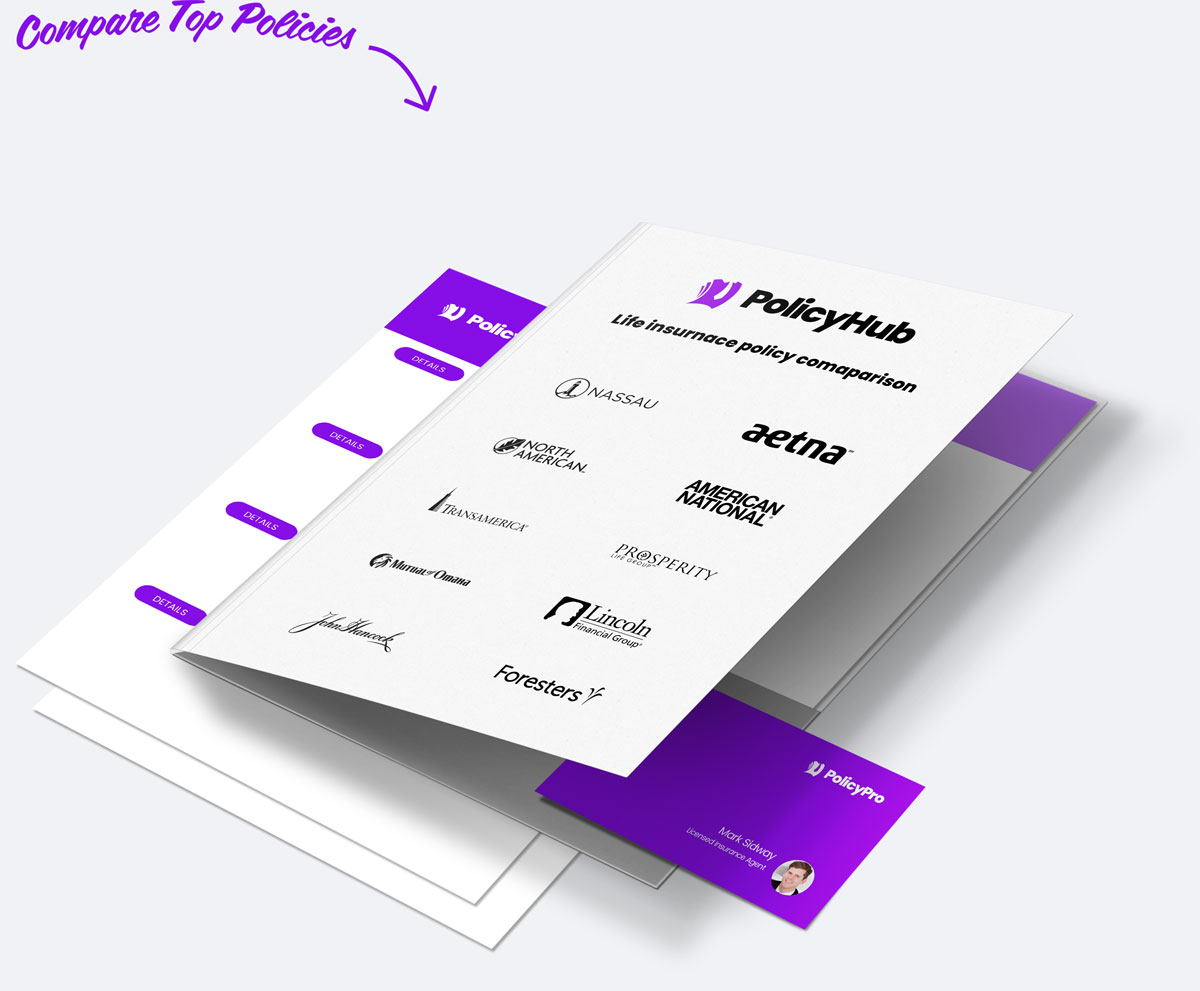

Compare over 20 life insurance policies in as little as 5 minutes.

With PolicyHub you get to compare over 20 life insurance policy providers in as little as 5 minutes. Save time. Save big. Get started now.

Compare over 20 top providers in South Houston, TX

Your one-stop-shop to compare all the rates, all at once.

With PolicyHub you get:

Over 20 policy provider comparison.

Explore policies in South Houston, TX from all the leading providers and choose the right one for you.

Locked in rate discount and exclusive deals.

Benefit from exclusive deals offered to residents in South Houston, TX, and lock in rate discounts.

Customized policies just for you.

Our team tailors policies to South Houston, TX residents, meaning optimal coverage at competitive rates.

"I was totally lost trying to find the right life insurance until I found PolicyHub. I was able to work with a licensed agent to compare all my options all at one. I got the perfect plan for me at a cheaper rate than I expected."

Barbara Winters

Policy Holder

ATTN: 2024 South Houston, TX rates just released!

Get the latest insurance rates for 2024 and lock in your policy today! Get started comparing policies today.

Get the perfect plan with the cheapest rates in 3 easy steps.

Life insurance in South Houston, TX Done in 3 easy steps

Step 1

Tell us about yourself.

Finding the perfect life insurance policy starts with answering a few questions to help us serve you better.

Step 2

Compare rates & plans with a pro.

Discuss your options with a licensed insurance agent. Compare different plans to find the best policy with the best rates.

Step 3

Lock in cheap rates.

Secure the lowest rates and lock in the perfect life insurance policy for you and your family.

"I lost hope trying to find a life insurance policy that wasn't insanely expensive. Thankfully PolicyHub helped me find the perfect policy that is affordable with high coverage. Thank you!"

Bill Barton

Policy Holder

PolicyHub is the smartest way to protect the people that matter most.

Safeguard Your Family

Life insurance means safeguarding your family in a worst-case scenario. Don't risk it.

Gain Peace of Mind

Far too many Americans are financially blindsided by the death of a loved one. But not your family.

Protect Your Business

Protect your business by ensuring a smooth transition of ownership with the right life insurance.

Beat Estate Taxes

Inheritance or estate taxes is burdensome for your heirs. A life insurance policy can help.

Invest in Your Future

For less than $1 per day, you can make a huge contribution to your family's financial safety.

Build Your Legacy

Through a life insurance policy, you can leave behind a legacy for your loved ones.

Get started in less than 5 minutes.

With PolicyHub getting started is easy. Compare all the rates from all the providers in South Houston, TX. Get started in under 5 minutes.

All your life insurance needs in one place.

Term Life Insurance

Term insurance provides coverage for a set period of time, and it's a cost-efficient way to get the maximum coverage. It's an excellent solution for folks who have a temporary need for coverage.

Whole Life Insurance

Whole life insurance is coverage that lasts your entire life. This type of insurance also has a cash value component that grows over time, offering potential for financial growth along with lifelong coverage.

Universal Life Insurance

Universal life insurance is flexible coverage that lets you adjust your premiums and death benefits as your circumstances change throughout life. This flexibility makes it a popular choice.

No-Medical-Exam Life Insurance

No-medical-exam life insurance allows you to dodge the medical examination usually required for life insurance policies. It's perfect for individuals who want a swift approval process or have health concerns.

"Highly HIGHLY recommend PolicyHub if you need life insurance. They saved me sooo much time and money on my policy, it's nuts. Comparing all the providers at once is a game changer."

Chris Stephens

Policy Holder

Introducing PolicyHub Price Match Guarantee

Our priority is to save you money while getting you the right coverage. If you find a lower rate for a similar policy anywhere else, we'll match it! With PolicyHub, you can rest assured knowing you're getting the best price in South Houston, TX.

Save time and get the best policy with the cheapest rates. Guaranteed.

|

Option 1 | Option 2 | ||

|---|---|---|---|---|

| 100% Digital | ||||

| Licensed Agents | ||||

| Expert Support | ||||

| Get Started in 5 Minutes | ||||

| Decades of Experience | ||||

| Compare 20+ Providers | ||||

| Zero Hidden Costs | ||||

| Top Insurance Providers |

"I knew I needed life insurance but I didn't know where to go. I talked with a few other companies but the cost was outrageous. I found PolicyHub and found the perfect plan for me at an affordable cost."

Wendy Smith

Policy Holder

Frequent Questions...

Choosing the right life insurance policy in South Houston, TX depends on your individual situation and needs. Looking at your long term goals is important to ensure that the policy chosen meets all of your needs. For example, if you have children or dependents and you are the breadwinner of the family, then you should choose a policy that provides enough coverage in the event of an untimely death. It’s also important to consider the premium range, especially if you are on a budget.

What are the common policy exclusions from life insurance companies in South Houston?

Life insurance policies can vary widely depending on the type of policy and provider. Generally, life insurance policies do not cover suicide, illnesses or conditions that existed before the policy was issued, as well as any certain risky activities like sky diving or scuba diving. In South Houston, TX, most policies will also exclude damages caused to the insured by war or civil unrest. Therefore, it's important for policy holders, especially those in South Houston, Texas, to read their policy documents carefully and learn about the common exclusions that apply to their life insurance agreement.

How much of a life insurance policy South Houston do I need?

It depends on your specific needs and lifestyle in South Houston, TX. A good rule of thumb is to make sure you have enough coverage to replace your income in the event of an untimely death and cover final expenses. If you are the only provider in your household, consider getting more coverage than if you have a spouse who could step in to provide financially. Additionally, it's important to review your life insurance policy periodically to make sure it still meets your needs, as your income, number of dependents, and other factors may change over time.

What's the cost of life insurance near South Houston?

Life insurance cost in South Houston, TX will vary greatly depending on the type and amount of coverage you are looking for as well as the company you decide to go with. Generally, the average cost of life insurance for a healthy, middle-aged individual in South Houston, TX can range anywhere from $50-$100 a month. However, multiple factors such as the age, gender, and health of the person getting the insurance can also play a role in the overall cost of life insurance. It's always best to compare quotes from various insurance companies before making a decision.

Do I need a medical exam to contact a life insurance company South Houston?

Depending on the type of life insurance and the amount of coverage you need, a medical exam may or may not be required to obtain a policy. Generally speaking, life insurance companies located in South Houston, TX will require a medical examination if you need more than $500,000 in coverage, you're applying for a policy in your advanced years, or you have certain health concerns or allergies. However, if you're looking for a smaller policy, the examination may not be necessary.

In South Houston, TX, if your beneficiary passes away before you do, your life insurance policy generally remains in place as a valid contract. The primary beneficiary may be replaced with a secondary beneficiary in accordance with the provisions of your policy. If you do not name a successor beneficiary, the proceeds of the policy will generally be paid to your estate. You should inform your insurance company of any changes to your beneficiary designation.

What happens to life insurance policies near South Houston if I outlive the term?

In South Houston, TX, if you outlive the term of your life insurance policy, the policy will no longer provide a death benefit; however, some policies may provide a return of a portion of the premiums paid if they are indexed universal life policies or multi-year guaranteed policies. You may also have the option to convert the policy to a permanent policy and continue with coverage. It's important to review the details of your policy and speak with an agent or life insurance professional to explore all available options.

What does 'level term' mean regarding life insurance in South Houston?

In South Houston, Texas, 'level term' in a life insurance policy refers to an insurance product in which the premium payment stays the same over the life of the policy. This type of policy provides the policyholder with a death benefit that will remain the same for the duration of coverage. Level term policies are different than decreasing term policies, which provide premiums that decrease over time but do not provide the assurance of a fixed death benefit. Level term policies are commonly used as financial tools for providing life insurance coverage for a specified length of time.

Can I get a South Houston life insurance policy for my children?

Yes, you can find life insurance for your children here in South Houston, TX. Numerous insurance providers offer plans for dependent children that provide basic coverage at an affordable rate. These policies are designed to meet the needs of growing families and offer valuable financial security should the unexpected happen. Policies are typically available for children up to the age of 25, and many companies also offer riders to customize your child's coverage. It's a wise idea to understand the terms and conditions of the policies thoroughly before signing up, but with so many options available, you'll be sure to find one that suits your needs.

What is the 'free look period' from a South Houston life insurance company?

The 'free look period' in life insurance is a time period typically lasting 10 to 30 days for policyholders in South Houston, TX, to review their life insurance contract. During the free look period, policyholders can decide whether or not to keep the policy without any financial or penalty repercussions. Policyholders are allowed to return the policy during the free look period for any reason and receive a full refund of the premium. It is important to review all details of the policy before signing during this time period to ensure there are no discrepancies or information that wasn't included prior to purchase.

Compare Life Insurance Policies

Get started today and compare over 37 life insurance providers in as little as 15 minutes.

© 2024 PolicyHub - all rights reserved