Taking too long? Close loading screen.

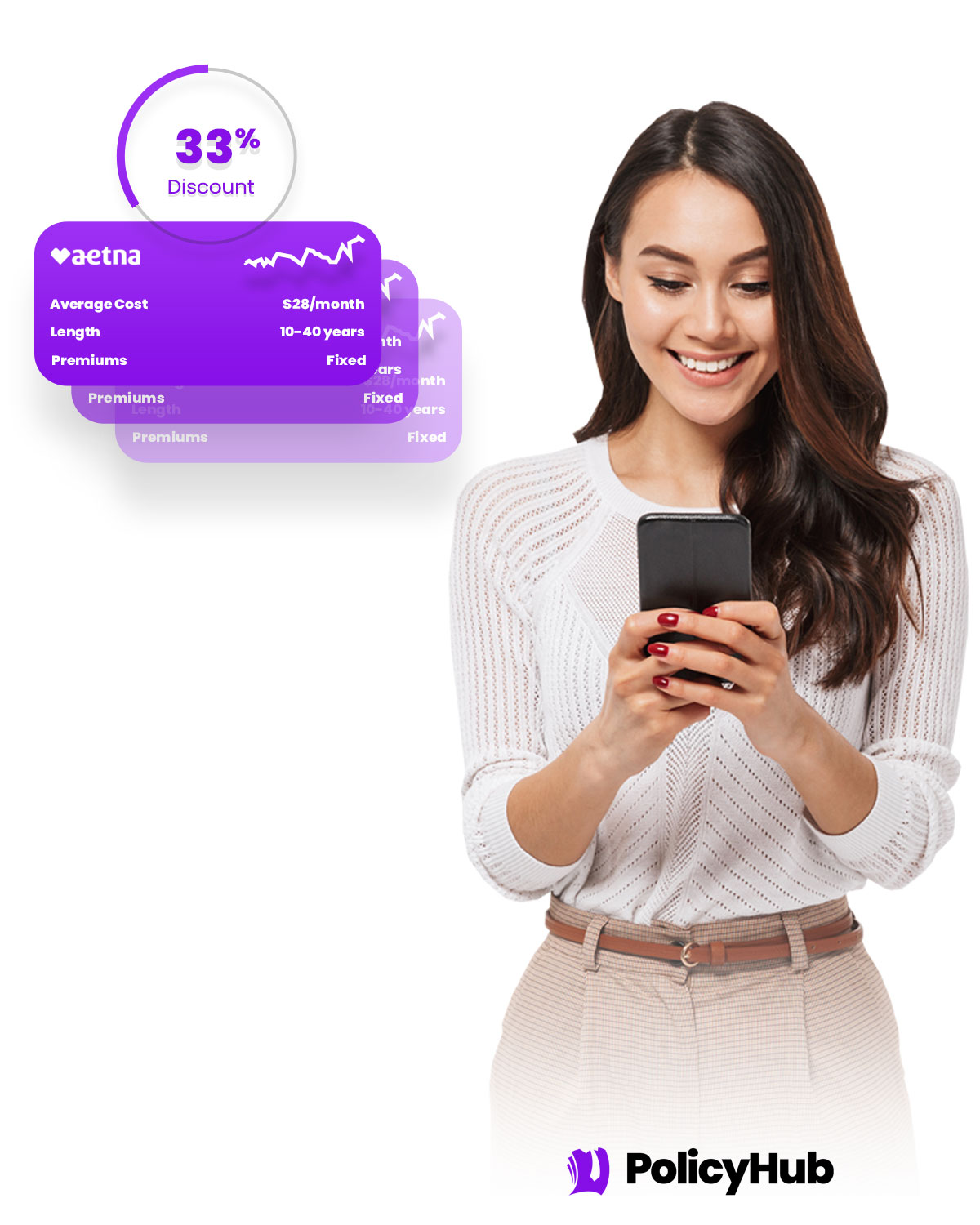

Compare over 20 life insurance policies in as little as 5 minutes.

With PolicyHub you get to compare over 20 life insurance policy providers in as little as 5 minutes. Save time. Save big. Get started now.

Compare over 20 top providers in Gladeview, FL

Your one-stop-shop to compare all the rates, all at once.

With PolicyHub you get:

Over 20 policy provider comparison.

Explore policies in Gladeview, FL from all the leading providers and choose the right one for you.

Locked in rate discount and exclusive deals.

Benefit from exclusive deals offered to residents in Gladeview, FL, and lock in rate discounts.

Customized policies just for you.

Our team tailors policies to Gladeview, FL residents, meaning optimal coverage at competitive rates.

"I was totally lost trying to find the right life insurance until I found PolicyHub. I was able to work with a licensed agent to compare all my options all at one. I got the perfect plan for me at a cheaper rate than I expected."

Barbara Winters

Policy Holder

ATTN: 2024 Gladeview, FL rates just released!

Get the latest insurance rates for 2024 and lock in your policy today! Get started comparing policies today.

Get the perfect plan with the cheapest rates in 3 easy steps.

Life insurance in Gladeview, FL Done in 3 easy steps

Step 1

Tell us about yourself.

Finding the perfect life insurance policy starts with answering a few questions to help us serve you better.

Step 2

Compare rates & plans with a pro.

Discuss your options with a licensed insurance agent. Compare different plans to find the best policy with the best rates.

Step 3

Lock in cheap rates.

Secure the lowest rates and lock in the perfect life insurance policy for you and your family.

"I lost hope trying to find a life insurance policy that wasn't insanely expensive. Thankfully PolicyHub helped me find the perfect policy that is affordable with high coverage. Thank you!"

Bill Barton

Policy Holder

PolicyHub is the smartest way to protect the people that matter most.

Safeguard Your Family

Life insurance means safeguarding your family in a worst-case scenario. Don't risk it.

Gain Peace of Mind

Far too many Americans are financially blindsided by the death of a loved one. But not your family.

Protect Your Business

Protect your business by ensuring a smooth transition of ownership with the right life insurance.

Beat Estate Taxes

Inheritance or estate taxes is burdensome for your heirs. A life insurance policy can help.

Invest in Your Future

For less than $1 per day, you can make a huge contribution to your family's financial safety.

Build Your Legacy

Through a life insurance policy, you can leave behind a legacy for your loved ones.

Get started in less than 5 minutes.

With PolicyHub getting started is easy. Compare all the rates from all the providers in Gladeview, FL. Get started in under 5 minutes.

All your life insurance needs in one place.

Term Life Insurance

Term insurance provides coverage for a set period of time, and it's a cost-efficient way to get the maximum coverage. It's an excellent solution for folks who have a temporary need for coverage.

Whole Life Insurance

Whole life insurance is coverage that lasts your entire life. This type of insurance also has a cash value component that grows over time, offering potential for financial growth along with lifelong coverage.

Universal Life Insurance

Universal life insurance is flexible coverage that lets you adjust your premiums and death benefits as your circumstances change throughout life. This flexibility makes it a popular choice.

No-Medical-Exam Life Insurance

No-medical-exam life insurance allows you to dodge the medical examination usually required for life insurance policies. It's perfect for individuals who want a swift approval process or have health concerns.

"Highly HIGHLY recommend PolicyHub if you need life insurance. They saved me sooo much time and money on my policy, it's nuts. Comparing all the providers at once is a game changer."

Chris Stephens

Policy Holder

Introducing PolicyHub Price Match Guarantee

Our priority is to save you money while getting you the right coverage. If you find a lower rate for a similar policy anywhere else, we'll match it! With PolicyHub, you can rest assured knowing you're getting the best price in Gladeview, FL.

Save time and get the best policy with the cheapest rates. Guaranteed.

|

Option 1 | Option 2 | ||

|---|---|---|---|---|

| 100% Digital | ||||

| Licensed Agents | ||||

| Expert Support | ||||

| Get Started in 5 Minutes | ||||

| Decades of Experience | ||||

| Compare 20+ Providers | ||||

| Zero Hidden Costs | ||||

| Top Insurance Providers |

"I knew I needed life insurance but I didn't know where to go. I talked with a few other companies but the cost was outrageous. I found PolicyHub and found the perfect plan for me at an affordable cost."

Wendy Smith

Policy Holder

Frequent Questions...

Life insurance provides a financial safety net for Gladeview, FL residents and their families in the event of an unexpected death. It enables customers to purchase coverage that is tailored to their needs and budget. Generally, life insurance works by allowing customers to pay a set premium in exchange for a set benefit that can be paid out upon their death. In addition to providing peace of mind in the form of a financial security, many life insurance policies also include additional coverage such as critical illness or disability insurance.

According to life insurance companies in Gladeview, what's the difference between term and whole life insurance?

Term life insurance is designed to provide coverage for a set period of time, while Whole Life Insurance offers coverage for your entire life. Whole Life Insurance can help provide vital financial protection for you and your loved ones in Gladeview, FL and can be a key part of your long-term financial security. Whole Life Insurance can build cash value, offering you the ability to access some of that money in the future if needed. Term Life Insurance, on the other hand, does not build cash value and only provides a death benefit should you pass away during the insured term.

How much of a life insurance policy Gladeview do I need?

It depends on several factors such as your lifestyle, household income, and assets; however, Gladeview, FL residents should generally aim for life insurance coverage that is 5 to 10 times their annual salary. It's important to consider other aspects like providing college tuition for children or caretaking expenses for aging parents since the money can be used for various purposes. Ultimately, the most sensible way to determine the amount of coverage you need is to by talking to an insurance agent and going through a thorough assessment of your individual financial situation.

How do insurance companies assess risk with life insurance near Gladeview?

Insurance companies assess risk when issuing a policy in a variety of ways. For Gladeview, FL, insurance companies typically review recent claims data and financial records about you as an individual or your business. They will also review any available building codes and safety records pertinent to the area. Companies may request an onsite inspection, to review any potential hazards, check for condition, and verify occupancy. Community bylaws, local area climate and weather data, and records of any previous losses are also taken into account when assessing risks.

Does a life insurance company Gladeview cover death due to accidents or suicide?

In Gladeview, FL, most life insurance policies do cover death due to both accidents and suicide, as long as repayment of any existing debt is covered. However, as with all insurance policies, there may be some exclusions and limitations, so it is important to check with your insurance provider to understand the specifics of your insurance plan. It is also important to ensure that the policy you select is sufficient to cover any burial or other end of life expenses in addition to any existing debt.

If your beneficiary for your life insurance policy predeceases you in Gladeview, FL, the policy will go through a probate process. Upon the beneficiary passing, the policy will be distributed to the estate of the beneficiary as a part of their estate plan. The policy will then be administered to the designated executor of the estate who will be responsible for seeing that the policy's proceeds are distributed to any other remaining beneficiaries according to the estate plan. This process takes place according to the laws of the state of Florida and the documentation accompanying the policy.

Are payouts from life insurance policies near Gladeview taxable?

In Gladeview, FL, life insurance payouts are generally not taxable. This is due to the fact that these insurance proceeds are typically paid to beneficiaries based on the designation of the policyholders in their insurance documents. However, if you are considering taking out life insurance or are a beneficiary of a deceased individual, it is important to consult with an experienced tax professional to ensure that all relevant tax considerations have been taken into account.

Can I borrow against my life insurance in Gladeview?

In Gladeview, FL, you can borrow against your life insurance policy. However, how much money you can borrow against and the specific eligibility requirements can vary widely from policy to policy. Before you decide to take the loan, it is important that you carefully assess the full financial implications associated with the loan and determine if the benefits outweigh the risks of taking the loan. Additionally, many life insurance policies have stipulations that limit borrowing to only certain durations, modes of payment and interest rate.

Can I get a Gladeview life insurance policy for my children?

Yes, it is possible to get life insurance for your children in Gladeview, Florida. Your local insurance companies can provide policies designed specifically for them to help provide for their future needs. Such policies are typically low-cost yet provide a number of great benefits which can help protect them in case of any unexpected circumstances. You should talk to an insurance professional to discuss your family’s needs and find the best policy to meet them. Be sure to compare the coverage and details of each policy before deciding on the best fit for your family.

How can I check if a Gladeview life insurance company is legitimate?

To check if a life insurance company is legitimate, one option is to reviewGladeview's Department of Financial Services' records to ensure that insurance companies have a valid license and are properly certified. Additionally, you might do an online search of the company's current ratings or find out if the company is accredited by the National Association of Insurance Commissioners or another relevant organization. You can also review online customer reviews of the company to provide further information about its reliability.

Compare Life Insurance Policies

Get started today and compare over 37 life insurance providers in as little as 15 minutes.

© 2024 PolicyHub - all rights reserved