Taking too long? Close loading screen.

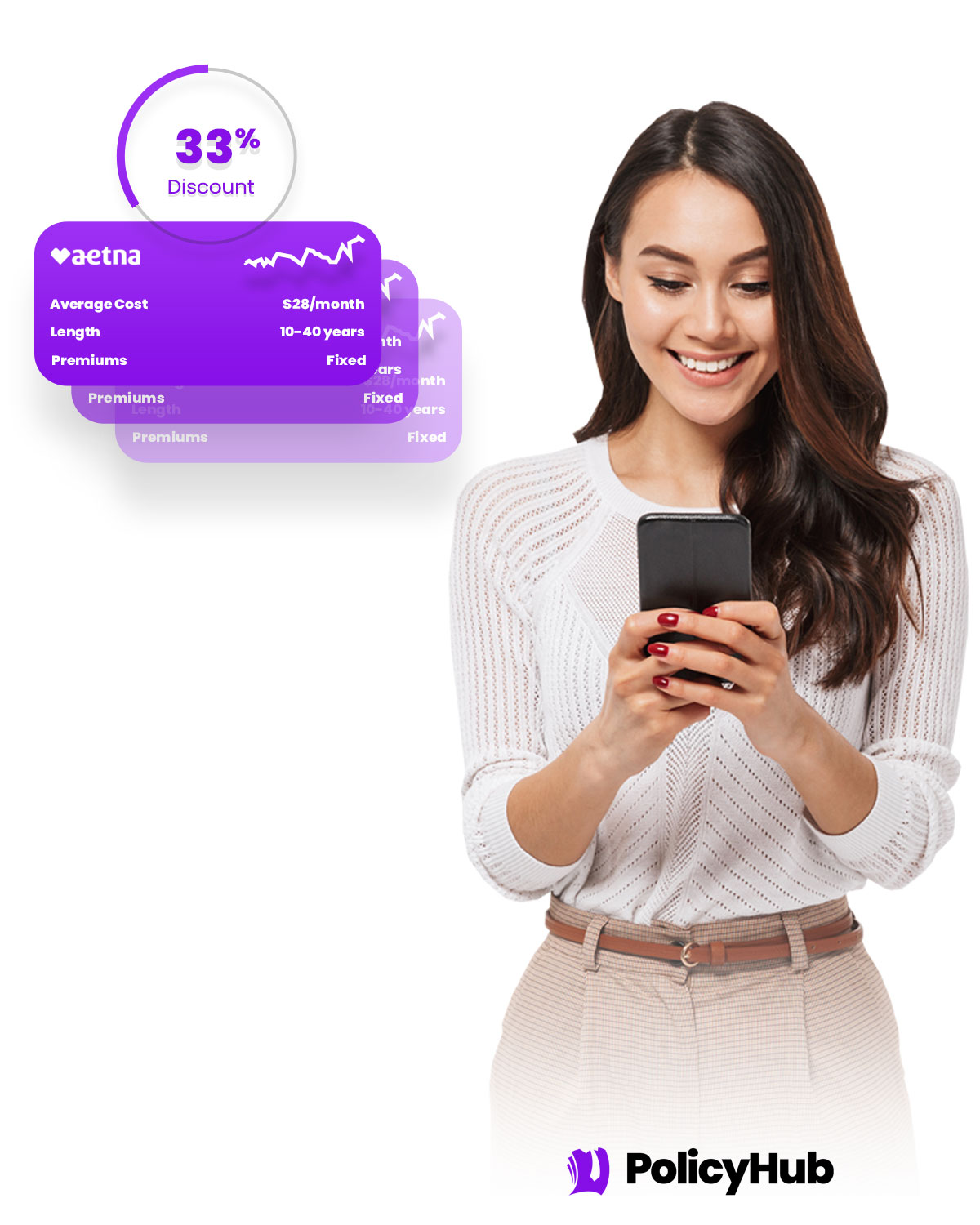

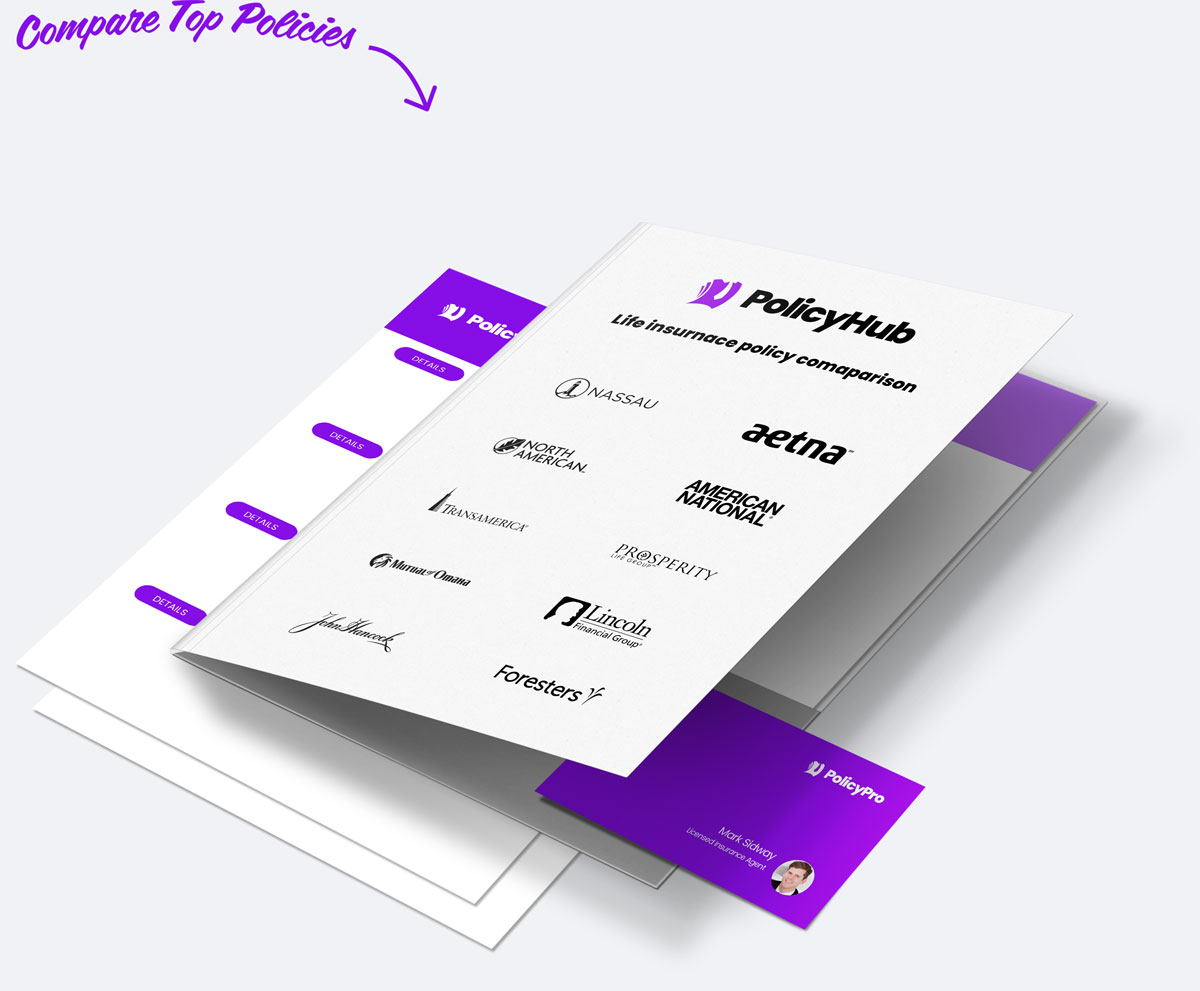

Compare over 20 life insurance policies in as little as 5 minutes.

With PolicyHub you get to compare over 20 life insurance policy providers in as little as 5 minutes. Save time. Save big. Get started now.

Compare over 20 top providers in Red Bank, TN

Your one-stop-shop to compare all the rates, all at once.

With PolicyHub you get:

Over 20 policy provider comparison.

Explore policies in Red Bank, TN from all the leading providers and choose the right one for you.

Locked in rate discount and exclusive deals.

Benefit from exclusive deals offered to residents in Red Bank, TN, and lock in rate discounts.

Customized policies just for you.

Our team tailors policies to Red Bank, TN residents, meaning optimal coverage at competitive rates.

"I was totally lost trying to find the right life insurance until I found PolicyHub. I was able to work with a licensed agent to compare all my options all at one. I got the perfect plan for me at a cheaper rate than I expected."

Barbara Winters

Policy Holder

ATTN: 2024 Red Bank, TN rates just released!

Get the latest insurance rates for 2024 and lock in your policy today! Get started comparing policies today.

Get the perfect plan with the cheapest rates in 3 easy steps.

Life insurance in Red Bank, TN Done in 3 easy steps

Step 1

Tell us about yourself.

Finding the perfect life insurance policy starts with answering a few questions to help us serve you better.

Step 2

Compare rates & plans with a pro.

Discuss your options with a licensed insurance agent. Compare different plans to find the best policy with the best rates.

Step 3

Lock in cheap rates.

Secure the lowest rates and lock in the perfect life insurance policy for you and your family.

"I lost hope trying to find a life insurance policy that wasn't insanely expensive. Thankfully PolicyHub helped me find the perfect policy that is affordable with high coverage. Thank you!"

Bill Barton

Policy Holder

PolicyHub is the smartest way to protect the people that matter most.

Safeguard Your Family

Life insurance means safeguarding your family in a worst-case scenario. Don't risk it.

Gain Peace of Mind

Far too many Americans are financially blindsided by the death of a loved one. But not your family.

Protect Your Business

Protect your business by ensuring a smooth transition of ownership with the right life insurance.

Beat Estate Taxes

Inheritance or estate taxes is burdensome for your heirs. A life insurance policy can help.

Invest in Your Future

For less than $1 per day, you can make a huge contribution to your family's financial safety.

Build Your Legacy

Through a life insurance policy, you can leave behind a legacy for your loved ones.

Get started in less than 5 minutes.

With PolicyHub getting started is easy. Compare all the rates from all the providers in Red Bank, TN. Get started in under 5 minutes.

All your life insurance needs in one place.

Term Life Insurance

Term insurance provides coverage for a set period of time, and it's a cost-efficient way to get the maximum coverage. It's an excellent solution for folks who have a temporary need for coverage.

Whole Life Insurance

Whole life insurance is coverage that lasts your entire life. This type of insurance also has a cash value component that grows over time, offering potential for financial growth along with lifelong coverage.

Universal Life Insurance

Universal life insurance is flexible coverage that lets you adjust your premiums and death benefits as your circumstances change throughout life. This flexibility makes it a popular choice.

No-Medical-Exam Life Insurance

No-medical-exam life insurance allows you to dodge the medical examination usually required for life insurance policies. It's perfect for individuals who want a swift approval process or have health concerns.

"Highly HIGHLY recommend PolicyHub if you need life insurance. They saved me sooo much time and money on my policy, it's nuts. Comparing all the providers at once is a game changer."

Chris Stephens

Policy Holder

Introducing PolicyHub Price Match Guarantee

Our priority is to save you money while getting you the right coverage. If you find a lower rate for a similar policy anywhere else, we'll match it! With PolicyHub, you can rest assured knowing you're getting the best price in Red Bank, TN.

Save time and get the best policy with the cheapest rates. Guaranteed.

|

Option 1 | Option 2 | ||

|---|---|---|---|---|

| 100% Digital | ||||

| Licensed Agents | ||||

| Expert Support | ||||

| Get Started in 5 Minutes | ||||

| Decades of Experience | ||||

| Compare 20+ Providers | ||||

| Zero Hidden Costs | ||||

| Top Insurance Providers |

"I knew I needed life insurance but I didn't know where to go. I talked with a few other companies but the cost was outrageous. I found PolicyHub and found the perfect plan for me at an affordable cost."

Wendy Smith

Policy Holder

Frequent Questions...

In Red Bank, TN, there are several different types of life insurance plans to choose from. Whole life insurance provides lifelong coverage with fixed premiums and lifetime death benefits. Term life insurance offers coverage for a defined period of years, typically 10, 20, or 30 years, with lower premiums. Universal life insurance provides flexible coverage and adjustable premiums, and variable life insurance ties the death benefit to market performance and can include an investment component. Red Bank residents may also benefit from an individual life insurance policy or group policy provided through their employer.

With life insurance companies in Red Bank, what happens to my policy if I move to another country?

If you move to another country from Red Bank, TN, you will need to reevaluate your life insurance policy. Depending on where you’re moving to, your current policy may not be valid anymore. In these instances, contact a qualified insurance broker in the country of your choice who can inform you about the local laws governing life insurance and give you advice about alternative coverage. Make sure to review all the terms and conditions prior to signing any new policy, as different countries may have additional stipulations.

What happens if I stop paying premiums on my life insurance policy Red Bank?

If you stop paying premiums on your life insurance policy in Red Bank, TN, without formally canceling the policy, it will enter a grace period – typically 30 days. During this period, the life insurance policy will remain in effect and any death benefits would still be payable to the beneficiaries. After the grace period expires, the policy will lapse and no longer be in effect. The policyholder may have the opportunity to reinstate their policy if they can make the backlog of missed payments in full, including interest or penalties.

How do insurance companies assess risk with life insurance near Red Bank?

Insurance companies in Red Bank, TN assess risk when issuing a policy by utilizing an individual's credit score, health records, age, driving record, occupation, and location among other points, to determine the likelihood of a claim. All of these elements are taken into account to construct a coverage plan and applicable premiums that would best suit an individual's needs. Additionally, companies may survey prior incidents in a designated area to understand what may be a common claim in and around Red Bank. Ultimately, the level of risk an individual poses will influence the type and cost of their policy.

Will a life insurance company Red Bank help me if I have a pre-existing medical condition?

Yes, you can get life insurance if you have a pre-existing medical condition in Red Bank, TN. There are several companies that offer life insurance options for individuals who have existing critical illnesses. It is important to contact insurance agents to review all available plans, including term, whole and universal life insurance. Be sure to disclose all pre-existing medical conditions to the insurance agent so that they can ensure you are offered the best coverage for your needs and budget.

In Red Bank, TN, life insurance policies follow their terms and conditions as outlined when the policy was purchased. Generally, if a beneficiary predeceases the policyholder, the original terms of the policy will determine where the remaining funds from the policy are distributed. It is possible for the policyholder to name an alternate beneficiary in their policy, or when the policyholder dies without a valid beneficiary, the funds may be distributed according to the terms of the policy. In most cases, the funds will be distributed to the policyholder’s estate.

Are payouts from life insurance policies near Red Bank taxable?

Life insurance payouts may be taxable depending on the circumstances. In Red Bank, TN, life insurance premiums paid with after-tax dollars are generally non-taxable, however there may be exceptions if the details of the contract don't follow federal rules. For example, if the policy owner or beneficiary of the contract is someone other than the deceased, then taxes may be applicable. To be sure, people in Red Bank TN should seek the advice of a certified financial planner or tax professional when navigating the complexities of life insurance payouts.

Can I borrow against my life insurance in Red Bank?

In Red Bank, TN, you may be able to borrow against your life insurance policy if your policy allows. Some life insurance policies can be used as collateral for loans. Generally, you can borrow against cash value that accumulates in the policy over time, but you must be aware that borrowing can reduce the amount of money your beneficiaries will receive upon your death. Additionally, you will need to make sure you understand the repayment schedule and terms before taking out a loan. It's best to talk to your life insurance provider directly to ensure your policy allows borrowing and you understand all the potential implications.

Can I buy a Red Bank life insurance policy for another person, like my spouse or parent?

Yes, absolutely! In Red Bank, TN, you can easily purchase life insurance for your spouse, parent, or other loved one. Whether you're wanting to protect their financial future or ensure their final wishes are honored, life insurance can be a great option. An independent insurance agency can help you find the right policy and provide personalized advice so you can make the best decision for your loved one. Your local agent will be familiar with the policies and laws applicable in Red Bank, TN and can connect you with the best possible plan.

How do I apply with a Red Bank life insurance company?

In Red Bank, TN, you can apply for life insurance with local and leading providers. There are a variety of options available to suit your needs and budget. To apply for life insurance, you must provide your information, such as age, occupation, health history, and lifestyle choices, and submit your application. Depending on the type of policy, there may be additional documents you need to provide. Once your application is approved, you'll pay your premiums and be provided with a policy and certificate of coverage.

Compare Life Insurance Policies

Get started today and compare over 37 life insurance providers in as little as 15 minutes.

© 2024 PolicyHub - all rights reserved