Taking too long? Close loading screen.

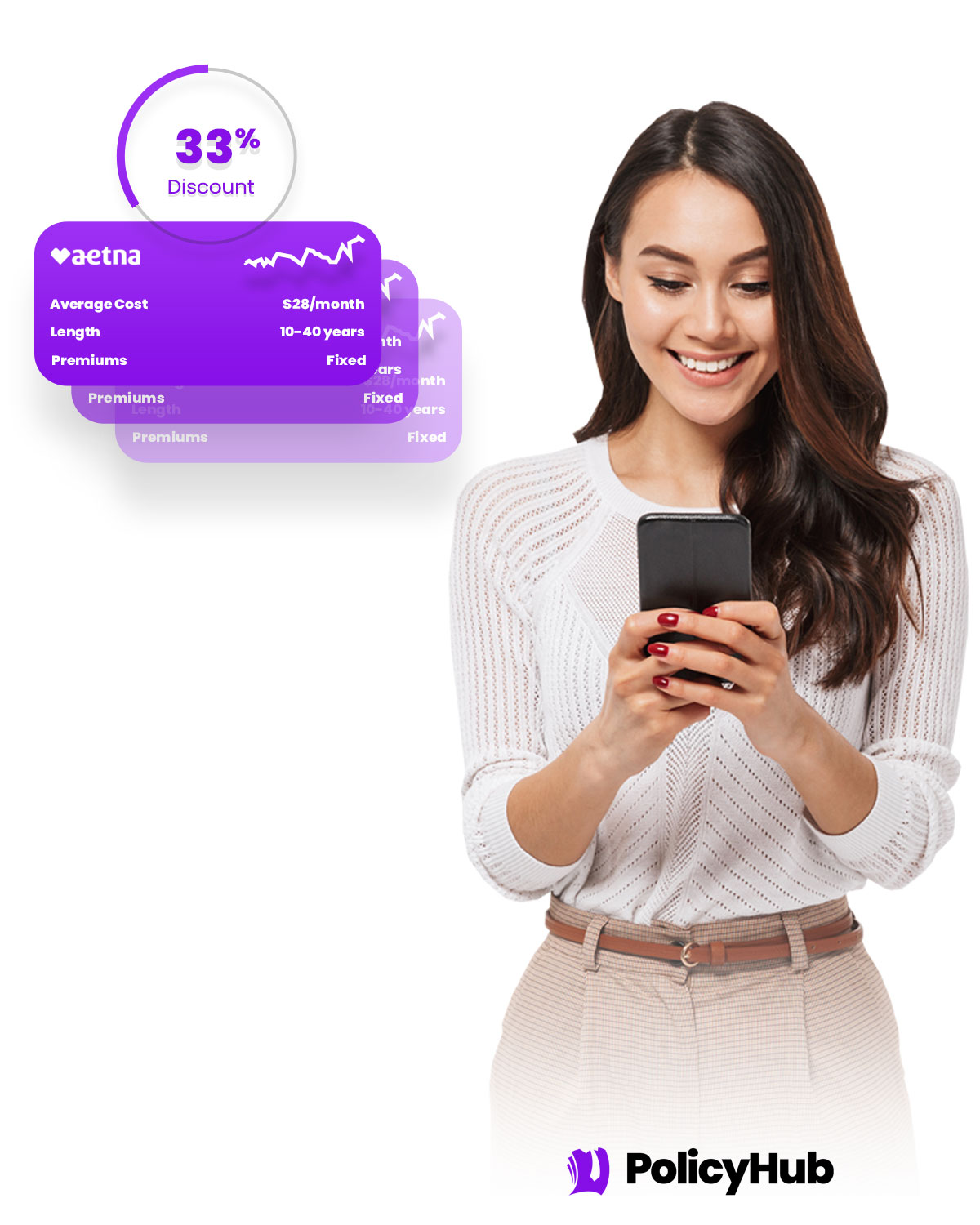

Compare over 20 life insurance policies in as little as 5 minutes.

With PolicyHub you get to compare over 20 life insurance policy providers in as little as 5 minutes. Save time. Save big. Get started now.

Compare over 20 top providers in Highland, IL

Your one-stop-shop to compare all the rates, all at once.

With PolicyHub you get:

Over 20 policy provider comparison.

Explore policies in Highland, IL from all the leading providers and choose the right one for you.

Locked in rate discount and exclusive deals.

Benefit from exclusive deals offered to residents in Highland, IL, and lock in rate discounts.

Customized policies just for you.

Our team tailors policies to Highland, IL residents, meaning optimal coverage at competitive rates.

"I was totally lost trying to find the right life insurance until I found PolicyHub. I was able to work with a licensed agent to compare all my options all at one. I got the perfect plan for me at a cheaper rate than I expected."

Barbara Winters

Policy Holder

ATTN: 2024 Highland, IL rates just released!

Get the latest insurance rates for 2024 and lock in your policy today! Get started comparing policies today.

Get the perfect plan with the cheapest rates in 3 easy steps.

Life insurance in Highland, IL Done in 3 easy steps

Step 1

Tell us about yourself.

Finding the perfect life insurance policy starts with answering a few questions to help us serve you better.

Step 2

Compare rates & plans with a pro.

Discuss your options with a licensed insurance agent. Compare different plans to find the best policy with the best rates.

Step 3

Lock in cheap rates.

Secure the lowest rates and lock in the perfect life insurance policy for you and your family.

"I lost hope trying to find a life insurance policy that wasn't insanely expensive. Thankfully PolicyHub helped me find the perfect policy that is affordable with high coverage. Thank you!"

Bill Barton

Policy Holder

PolicyHub is the smartest way to protect the people that matter most.

Safeguard Your Family

Life insurance means safeguarding your family in a worst-case scenario. Don't risk it.

Gain Peace of Mind

Far too many Americans are financially blindsided by the death of a loved one. But not your family.

Protect Your Business

Protect your business by ensuring a smooth transition of ownership with the right life insurance.

Beat Estate Taxes

Inheritance or estate taxes is burdensome for your heirs. A life insurance policy can help.

Invest in Your Future

For less than $1 per day, you can make a huge contribution to your family's financial safety.

Build Your Legacy

Through a life insurance policy, you can leave behind a legacy for your loved ones.

Get started in less than 5 minutes.

With PolicyHub getting started is easy. Compare all the rates from all the providers in Highland, IL. Get started in under 5 minutes.

All your life insurance needs in one place.

Term Life Insurance

Term insurance provides coverage for a set period of time, and it's a cost-efficient way to get the maximum coverage. It's an excellent solution for folks who have a temporary need for coverage.

Whole Life Insurance

Whole life insurance is coverage that lasts your entire life. This type of insurance also has a cash value component that grows over time, offering potential for financial growth along with lifelong coverage.

Universal Life Insurance

Universal life insurance is flexible coverage that lets you adjust your premiums and death benefits as your circumstances change throughout life. This flexibility makes it a popular choice.

No-Medical-Exam Life Insurance

No-medical-exam life insurance allows you to dodge the medical examination usually required for life insurance policies. It's perfect for individuals who want a swift approval process or have health concerns.

"Highly HIGHLY recommend PolicyHub if you need life insurance. They saved me sooo much time and money on my policy, it's nuts. Comparing all the providers at once is a game changer."

Chris Stephens

Policy Holder

Introducing PolicyHub Price Match Guarantee

Our priority is to save you money while getting you the right coverage. If you find a lower rate for a similar policy anywhere else, we'll match it! With PolicyHub, you can rest assured knowing you're getting the best price in Highland, IL.

Save time and get the best policy with the cheapest rates. Guaranteed.

|

Option 1 | Option 2 | ||

|---|---|---|---|---|

| 100% Digital | ||||

| Licensed Agents | ||||

| Expert Support | ||||

| Get Started in 5 Minutes | ||||

| Decades of Experience | ||||

| Compare 20+ Providers | ||||

| Zero Hidden Costs | ||||

| Top Insurance Providers |

"I knew I needed life insurance but I didn't know where to go. I talked with a few other companies but the cost was outrageous. I found PolicyHub and found the perfect plan for me at an affordable cost."

Wendy Smith

Policy Holder

Frequent Questions...

Life insurance is a form of protection to help provide financial security for loved ones in Highland, IL, in the event of the insured’s death. It can help reduce family’s stress after a loss by replacing lost income and providing financial support to cover funeral and other expenses. Life insurance can also help provide for a child's education, help pay off a mortgage, and protect a business upon the death of an owner or key employee. There are many different types of life insurance and choosing the right one can depend on the specific needs and goals of the person insured.

According to life insurance companies in Highland, what's the difference between term and whole life insurance?

Term life insurance in Highland, IL offers protection for a specific period of time, typically from 10 to 30 years. After the term expires, coverage expires and the beneficiary does not receive any death benefit. Whole life insurance, on the other hand, is permanent coverage that stays in effect for the entire life of the insured, as long as premiums are paid. Whole life policies also build cash value that can be used during the life of the insured. Whole life policies can also be used as an investment vehicle by providing life insurance protection, as well as a cash value investment option.

Can I buy more than one life insurance policy Highland?

Yes, you can buy multiple life insurance policies if desired. It may be a smart decision for residents of Highland, IL., as life insurance provides financial security for your loved ones in case of your premature death. Additionally, different insurance carriers often offer different terms and policy amounts, so you could diversify with multiple policies from different carriers for comprehensive coverage. Furthermore, multiple policies with the same insurance company may offer coverage at a lower cost than a single policy with the same amount of coverage, so it may be cost-efficient to purchase multiple policies.

How does inflation impact my policy with life insurance near Highland?

Inflation impacts life insurance policies in Highland, IL in several ways. Because life insurance premiums are usually based on the insured's age, health, and the amount of coverage desired, inflation can effectively reduce the amount of coverage a policyholder can purchase for the same premium amount. Additionally, inflation can cause the death benefit to increase over time, allowing the policyholder's family to receive a larger death benefit should the insured die during the policy term.

Will a life insurance company Highland help me if I have a pre-existing medical condition?

Yes, you can get life insurance in Highland, IL if you have a pre-existing medical condition. Many of the life insurance companies that serve Highland consider pre-existing conditions in their underwriting process. Depending on the type of coverage and medical conditions needed, there are likely to be several options available. The best way to find out is to reach out to an experienced life insurance broker who can help you sort through the different policies, companies and coverages available. They can help you find the life insurance policy that meets your needs and budget.

In Highland, IL, you absolutely can change the beneficiary of your life insurance policy. Depending on the type and structure of the policy, the process may vary in terms of complexity. You should always review the policy and speak with a customer service representative at your insurance company to determine the official procedures for making the changes. You'll want to make sure that the required forms and documents are filled out, signed, and filed correctly and in a timely manner to ensure that the revised beneficiary designation is properly in place.

Are payouts from life insurance policies near Highland taxable?

Life insurance payouts received in Highland, IL are generally not taxable income; however, depending on the nature of the policy, there are a few exceptions. For example, when the policy was written with the pre-tax contributions of an employer, the proceeds may become taxable as part of the income. Additionally, if the policy was purchased with borrowed funds, any interest earned through the policy will need to be reported as taxable income. To ensure compliance with relevant laws, one should consult a qualified tax advisor based in Highland for confirmation.

What does 'level term' mean regarding life insurance in Highland?

In a life insurance policy, the term 'level term' refers to an insurance plan that has a fixed, predetermined insurance rate and fixed coverage amount over a certain period of time, typically for a period of 10-30 years. For example, if you are a resident of Highland, IL, you can get a level term policy from a licensed insurance provider that provides a fixed rate and coverage amount for a 10, 15 or 20 year period. This way, you can secure a fixed insurance policy rate today that will not increase over the term of the policy.

What is an accidental death and dismemberment Highland life insurance policy?

An accidental death and dismemberment (AD&D) insurance policy is a type of coverage intended to provide financial protection for you and your family in Highland, IL. In the event of an accidental death, your beneficiaries would receive the benefit of the policy, which could be used to cover medical bills, funeral expenses, lost income, or other support-related costs that could arise. If you are dismembered or suffer a serious injury from an accident, the policy will provide a cash sum to help you cover additional costs.

What is the 'free look period' from a Highland life insurance company?

The free look period is a 14-day window after purchasing life insurance when customers in Highland, IL can review the policy and return it for a full refund of the premiums paid, should they decide its features don't fit their needs. This period begins immediately after the policy is issued and ends 14-calendar days after delivery of the policy or the receipt of indemnity acknowledgement, depending on the type of policy purchased. During the free look period, customers can take their time to review the features and make the decision that best fits their needs, without taking on any additional risk.

Compare Life Insurance Policies

Get started today and compare over 37 life insurance providers in as little as 15 minutes.

© 2024 PolicyHub - all rights reserved