Taking too long? Close loading screen.

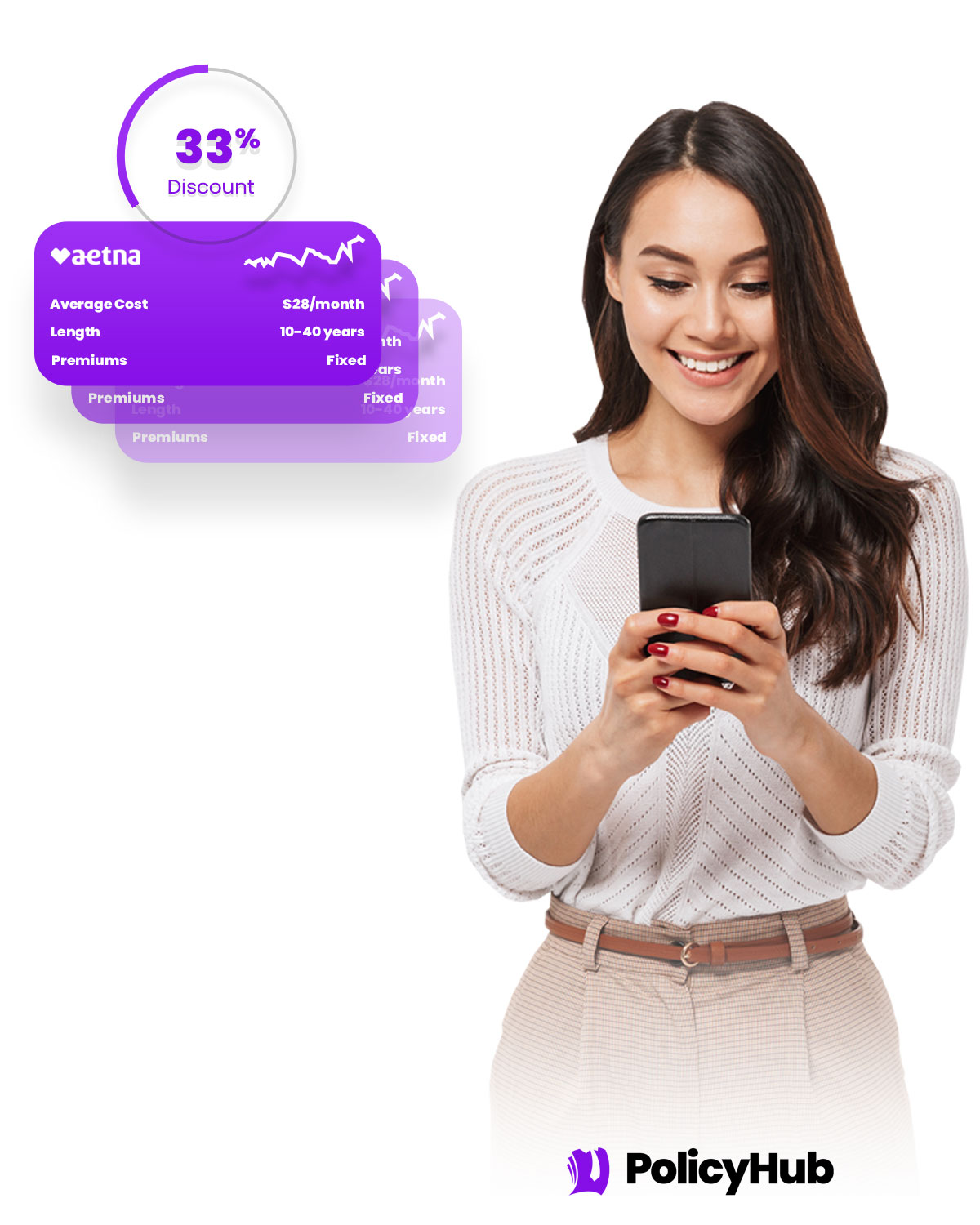

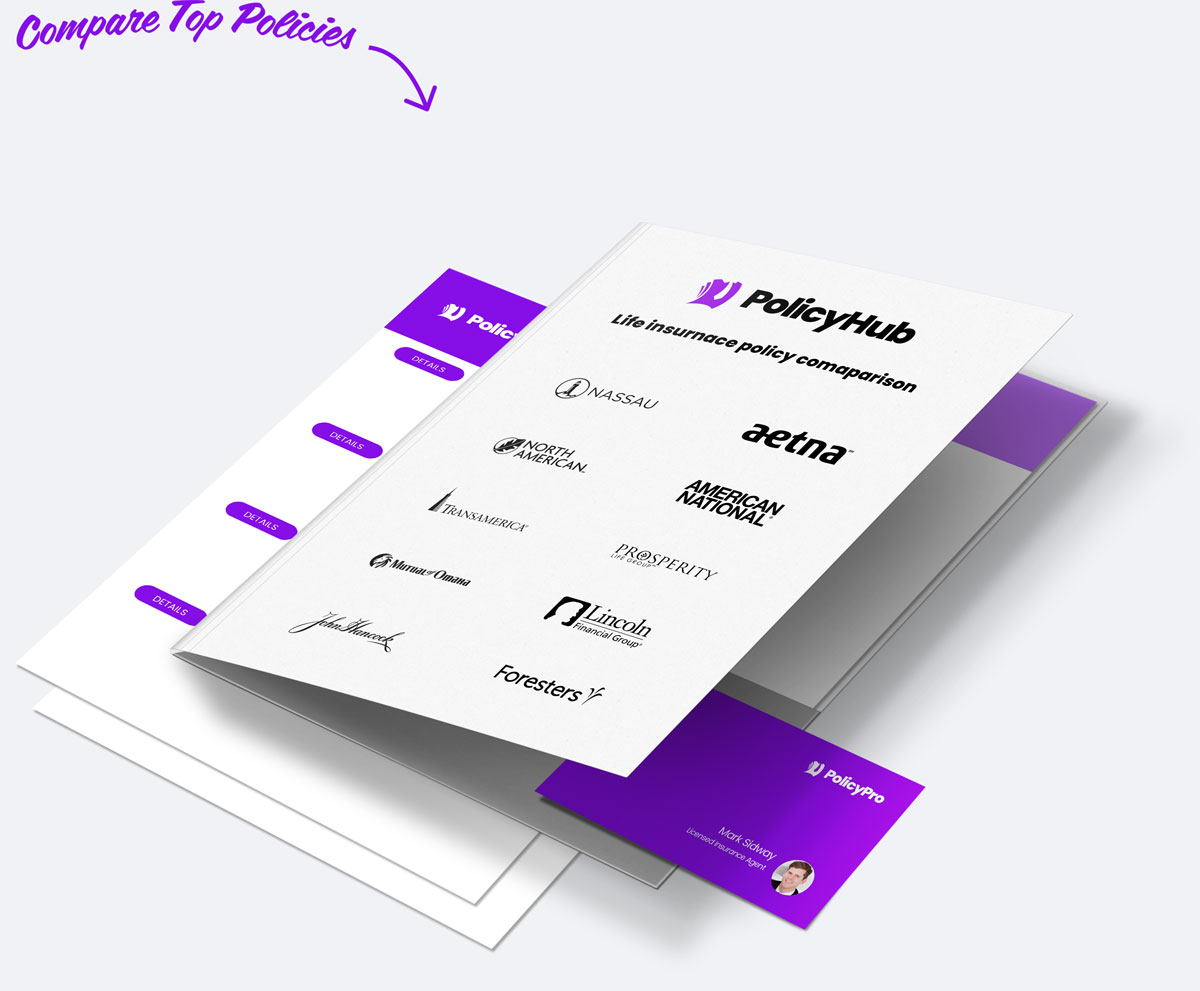

Compare over 20 life insurance policies in as little as 5 minutes.

With PolicyHub you get to compare over 20 life insurance policy providers in as little as 5 minutes. Save time. Save big. Get started now.

Compare over 20 top providers in Hartford, CT

Your one-stop-shop to compare all the rates, all at once.

With PolicyHub you get:

Over 20 policy provider comparison.

Explore policies in Hartford, CT from all the leading providers and choose the right one for you.

Locked in rate discount and exclusive deals.

Benefit from exclusive deals offered to residents in Hartford, CT, and lock in rate discounts.

Customized policies just for you.

Our team tailors policies to Hartford, CT residents, meaning optimal coverage at competitive rates.

"I was totally lost trying to find the right life insurance until I found PolicyHub. I was able to work with a licensed agent to compare all my options all at one. I got the perfect plan for me at a cheaper rate than I expected."

Barbara Winters

Policy Holder

ATTN: 2024 Hartford, CT rates just released!

Get the latest insurance rates for 2024 and lock in your policy today! Get started comparing policies today.

Get the perfect plan with the cheapest rates in 3 easy steps.

Life insurance in Hartford, CT Done in 3 easy steps

Step 1

Tell us about yourself.

Finding the perfect life insurance policy starts with answering a few questions to help us serve you better.

Step 2

Compare rates & plans with a pro.

Discuss your options with a licensed insurance agent. Compare different plans to find the best policy with the best rates.

Step 3

Lock in cheap rates.

Secure the lowest rates and lock in the perfect life insurance policy for you and your family.

"I lost hope trying to find a life insurance policy that wasn't insanely expensive. Thankfully PolicyHub helped me find the perfect policy that is affordable with high coverage. Thank you!"

Bill Barton

Policy Holder

PolicyHub is the smartest way to protect the people that matter most.

Safeguard Your Family

Life insurance means safeguarding your family in a worst-case scenario. Don't risk it.

Gain Peace of Mind

Far too many Americans are financially blindsided by the death of a loved one. But not your family.

Protect Your Business

Protect your business by ensuring a smooth transition of ownership with the right life insurance.

Beat Estate Taxes

Inheritance or estate taxes is burdensome for your heirs. A life insurance policy can help.

Invest in Your Future

For less than $1 per day, you can make a huge contribution to your family's financial safety.

Build Your Legacy

Through a life insurance policy, you can leave behind a legacy for your loved ones.

Get started in less than 5 minutes.

With PolicyHub getting started is easy. Compare all the rates from all the providers in Hartford, CT. Get started in under 5 minutes.

All your life insurance needs in one place.

Term Life Insurance

Term insurance provides coverage for a set period of time, and it's a cost-efficient way to get the maximum coverage. It's an excellent solution for folks who have a temporary need for coverage.

Whole Life Insurance

Whole life insurance is coverage that lasts your entire life. This type of insurance also has a cash value component that grows over time, offering potential for financial growth along with lifelong coverage.

Universal Life Insurance

Universal life insurance is flexible coverage that lets you adjust your premiums and death benefits as your circumstances change throughout life. This flexibility makes it a popular choice.

No-Medical-Exam Life Insurance

No-medical-exam life insurance allows you to dodge the medical examination usually required for life insurance policies. It's perfect for individuals who want a swift approval process or have health concerns.

"Highly HIGHLY recommend PolicyHub if you need life insurance. They saved me sooo much time and money on my policy, it's nuts. Comparing all the providers at once is a game changer."

Chris Stephens

Policy Holder

Introducing PolicyHub Price Match Guarantee

Our priority is to save you money while getting you the right coverage. If you find a lower rate for a similar policy anywhere else, we'll match it! With PolicyHub, you can rest assured knowing you're getting the best price in Hartford, CT.

Save time and get the best policy with the cheapest rates. Guaranteed.

|

Option 1 | Option 2 | ||

|---|---|---|---|---|

| 100% Digital | ||||

| Licensed Agents | ||||

| Expert Support | ||||

| Get Started in 5 Minutes | ||||

| Decades of Experience | ||||

| Compare 20+ Providers | ||||

| Zero Hidden Costs | ||||

| Top Insurance Providers |

"I knew I needed life insurance but I didn't know where to go. I talked with a few other companies but the cost was outrageous. I found PolicyHub and found the perfect plan for me at an affordable cost."

Wendy Smith

Policy Holder

Frequent Questions...

Life insurance is an important financial tool, and Hartford, CT residents can take advantage of its many benefits. It helps provide financial protection for loved ones in the event of an untimely death by providing a lump-sum payment to cover things like medical bills, educational expenses, and other expenses. In addition, it also acts as an asset-building tool, helping to build savings and secure a financial future for those you care about. With life insurance, you can provide yourself and your family with peace of mind and financial security.

According to life insurance companies in Hartford, what's the difference between term and whole life insurance?

Term Life Insurance in Hartford, CT is coverage for a set period of time. The policyholder will pay premiums for the length of the term and will be protected for that period of time. If they pass away during that term, the beneficiaries will receive the death benefit and the policy will end. Whole Life Insurance, also known as Permanent Insurance, offers lifelong coverage. Unlike Term Insurance, Whole Life Insurance has a cash value component which can grow with time. Additionally, unlike Term Insurance, Whole Life builds up a guaranteed cash value that can be withdrawn or borrowed against.

How much of a life insurance policy Hartford do I need?

Figuring out how much life insurance coverage you need is an important part of your financial planning process, and that amount varies from person to person depending on their individual needs and circumstances. For residents of Hartford, CT, a good starting point is to determine what your current and future financial obligations are so that you can calculate how much life insurance you would need to cover those obligations if something were to happen to you. This can include emergency funds, mortgage, debts, college costs and other expenses.

What's the cost of life insurance near Hartford?

The cost of life insurance in Hartford, CT, depends on several factors such as how much coverage you need, your age, medical history, and lifestyle habits. Generally, life insurance policy rates in Hartford can range from several hundred to several thousand dollars per year for a term policy. At The Hartford, we offer some of the most competitive life insurance rates in Connecticut. We also offer personalized life insurance plans to meet every customer's individual needs. With The Hartford, you can get a quick quote online and find the right life insurance policy for your budget and lifestyle.

Does a life insurance company Hartford cover death due to accidents or suicide?

Yes, life insurance policies in Hartford, CT are designed to cover death due to accidents, including work-related fatalities, and suicides. The Hartford offers various life insurance plans which bring financial coverage and peace of mind during difficult times. Plans cover a range of needs, from whole and term life insurance to retirement products. Additionally, policy holders can obtain access to financial advisors and customer service representatives who are dedicated to helping customers navigate the complicated process of making sure their lives and the lives of their loved ones are properly safeguarded with life insurance.

Yes, you can name more than one beneficiary for your life insurance policy from Hartford, Connecticut. Most insurance companies offer several options for how you want to split your benefits up between multiple beneficiaries, which can give you the flexibility you need to make sure your policy meets your unique needs and those of your loved ones. Depending on the company, you may have the option to designate two or more primary beneficiaries along with one or more contingent beneficiaries, or you may be able to split your benefits evenly across all of the beneficiaries you designate. Talk to your agent for more information on the specific options available to you.

Do life insurance policies near Hartford have any cash value?

Yes, many life insurance policies have cash value. The amount and terms surrounding cash value vary depending on the policy and the provider. If you live in Hartford, CT you should look into The Hartford, which offers many life insurance policies with great cash value options. Those options can include the ability to borrow against the policy for things like unexpected expenses or to invest in your future. Each policy at The Hartford is tailored to its customer, so you should consider their policies and ask the experts about what cash value features may be available to you.

What is convertible term life insurance in Hartford?

A convertible term life insurance policy is a type of policy offered in Hartford, CT and across the United States by many top life insurance carriers such as The Hartford. It gives policyholders the ability to convert their term life insurance policy into a permanent life insurance policy, allowing for additional coverage and flexibility throughout life’s changing circumstances. These policies are typically beneficial because of their low premiums and flexible conversion options. Additionally, original information such as an insurance application or medical exam doesn't need to be redone for conversions.

Can I buy a Hartford life insurance policy for another person, like my spouse or parent?

Yes, you can buy life insurance for another person, such as your spouse or parent, in Hartford, CT. Many carriers offer life insurance policies and other forms of life insurance through their local agencies. Many carriers also offer a variety of life insurance policies, such as term policies, universal policies, whole life policies, and so on. It is important to shop around for the best rates and coverage for the particular person you are seeking life insurance for, in order to make sure that they are protected.

How can I check if a Hartford life insurance company is legitimate?

To check if a life insurance company is legitimate, you should research the company and its claims process. A good place to start is the National Association of Insurance Commissioners (NAIC) website. It provides helpful information about insurance companies, including any complaints, claims, and closure history. Hartford, Connecticut is included in the NAIC's list of states where you can research any insurance companies that are operating there. You should also ask friends or family for reviews, look into customer service ratings, and read up on the general stability of the company before making a commitment.

Compare Life Insurance Policies

Get started today and compare over 37 life insurance providers in as little as 15 minutes.

© 2024 PolicyHub - all rights reserved