Taking too long? Close loading screen.

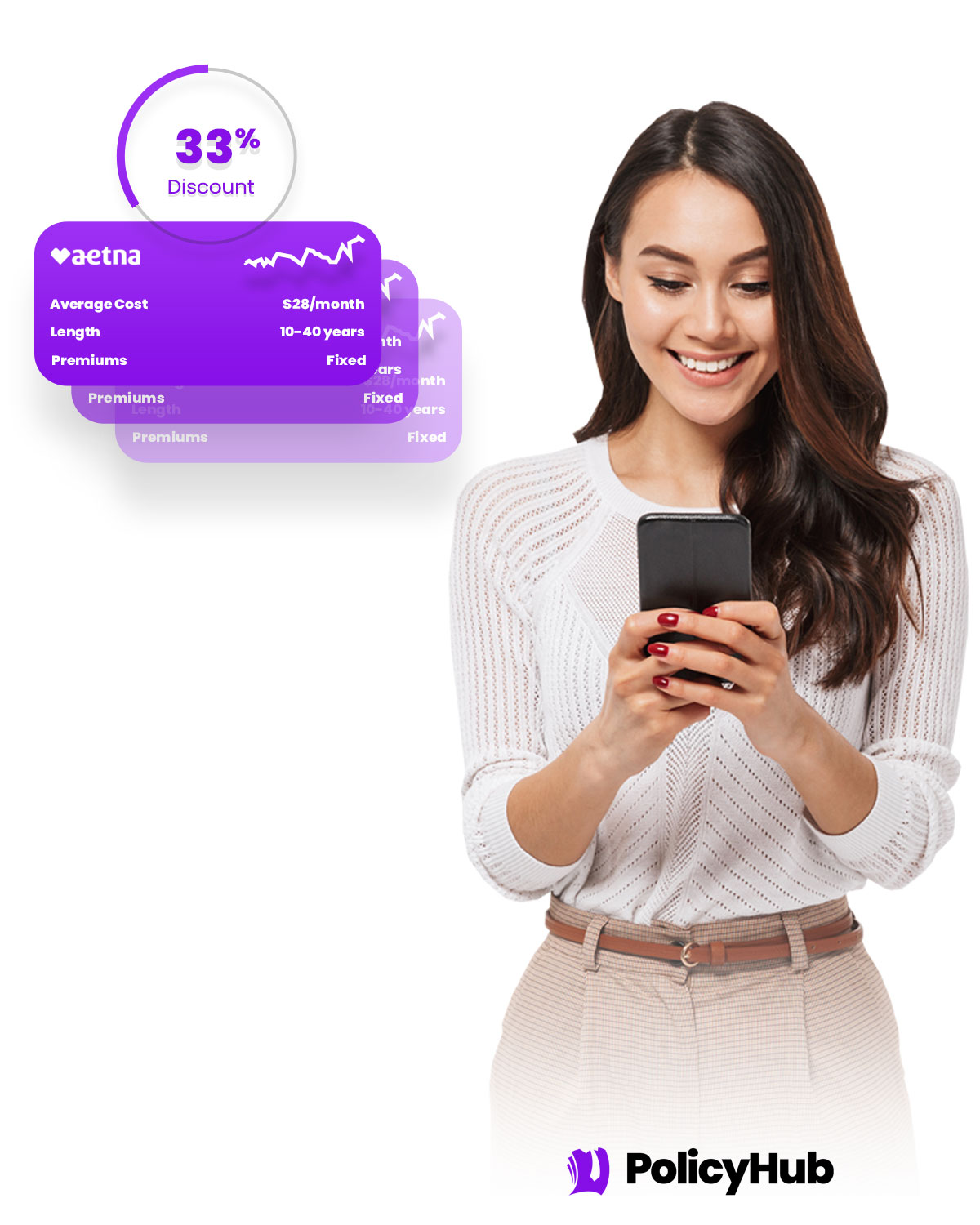

Compare over 20 life insurance policies in as little as 5 minutes.

With PolicyHub you get to compare over 20 life insurance policy providers in as little as 5 minutes. Save time. Save big. Get started now.

Compare over 20 top providers in Marion, AR

Your one-stop-shop to compare all the rates, all at once.

With PolicyHub you get:

Over 20 policy provider comparison.

Explore policies in Marion, AR from all the leading providers and choose the right one for you.

Locked in rate discount and exclusive deals.

Benefit from exclusive deals offered to residents in Marion, AR, and lock in rate discounts.

Customized policies just for you.

Our team tailors policies to Marion, AR residents, meaning optimal coverage at competitive rates.

"I was totally lost trying to find the right life insurance until I found PolicyHub. I was able to work with a licensed agent to compare all my options all at one. I got the perfect plan for me at a cheaper rate than I expected."

Barbara Winters

Policy Holder

ATTN: 2024 Marion, AR rates just released!

Get the latest insurance rates for 2024 and lock in your policy today! Get started comparing policies today.

Get the perfect plan with the cheapest rates in 3 easy steps.

Life insurance in Marion, AR Done in 3 easy steps

Step 1

Tell us about yourself.

Finding the perfect life insurance policy starts with answering a few questions to help us serve you better.

Step 2

Compare rates & plans with a pro.

Discuss your options with a licensed insurance agent. Compare different plans to find the best policy with the best rates.

Step 3

Lock in cheap rates.

Secure the lowest rates and lock in the perfect life insurance policy for you and your family.

"I lost hope trying to find a life insurance policy that wasn't insanely expensive. Thankfully PolicyHub helped me find the perfect policy that is affordable with high coverage. Thank you!"

Bill Barton

Policy Holder

PolicyHub is the smartest way to protect the people that matter most.

Safeguard Your Family

Life insurance means safeguarding your family in a worst-case scenario. Don't risk it.

Gain Peace of Mind

Far too many Americans are financially blindsided by the death of a loved one. But not your family.

Protect Your Business

Protect your business by ensuring a smooth transition of ownership with the right life insurance.

Beat Estate Taxes

Inheritance or estate taxes is burdensome for your heirs. A life insurance policy can help.

Invest in Your Future

For less than $1 per day, you can make a huge contribution to your family's financial safety.

Build Your Legacy

Through a life insurance policy, you can leave behind a legacy for your loved ones.

Get started in less than 5 minutes.

With PolicyHub getting started is easy. Compare all the rates from all the providers in Marion, AR. Get started in under 5 minutes.

All your life insurance needs in one place.

Term Life Insurance

Term insurance provides coverage for a set period of time, and it's a cost-efficient way to get the maximum coverage. It's an excellent solution for folks who have a temporary need for coverage.

Whole Life Insurance

Whole life insurance is coverage that lasts your entire life. This type of insurance also has a cash value component that grows over time, offering potential for financial growth along with lifelong coverage.

Universal Life Insurance

Universal life insurance is flexible coverage that lets you adjust your premiums and death benefits as your circumstances change throughout life. This flexibility makes it a popular choice.

No-Medical-Exam Life Insurance

No-medical-exam life insurance allows you to dodge the medical examination usually required for life insurance policies. It's perfect for individuals who want a swift approval process or have health concerns.

"Highly HIGHLY recommend PolicyHub if you need life insurance. They saved me sooo much time and money on my policy, it's nuts. Comparing all the providers at once is a game changer."

Chris Stephens

Policy Holder

Introducing PolicyHub Price Match Guarantee

Our priority is to save you money while getting you the right coverage. If you find a lower rate for a similar policy anywhere else, we'll match it! With PolicyHub, you can rest assured knowing you're getting the best price in Marion, AR.

Save time and get the best policy with the cheapest rates. Guaranteed.

|

Option 1 | Option 2 | ||

|---|---|---|---|---|

| 100% Digital | ||||

| Licensed Agents | ||||

| Expert Support | ||||

| Get Started in 5 Minutes | ||||

| Decades of Experience | ||||

| Compare 20+ Providers | ||||

| Zero Hidden Costs | ||||

| Top Insurance Providers |

"I knew I needed life insurance but I didn't know where to go. I talked with a few other companies but the cost was outrageous. I found PolicyHub and found the perfect plan for me at an affordable cost."

Wendy Smith

Policy Holder

Frequent Questions...

Life insurance is an essential financial protection tool for Marion, AR residents. It provides a financial safety net in case of the unexpected, giving Marionite families peace of mind and security that if something were to happen, such as an illness or death, they will be able to manage the financial costs. Life insurance also serves as a long-term savings vehicle, allowing the policy-holder to accumulate and receive a lump sum of money for retirement or other long-term financial goals. With today's ever-changing market, life insurance provides a secure savings vehicle to ensure a financial future.

Can life insurance policies be transferred or sold with life insurance companies in Marion?

The answer to the question of whether or not life insurance policies can be transferred or sold is yes. In Marion, Arkansas, you can work with a local life insurance provider or broker to transfer a policy you already have or sell a policy to someone else. It's important to keep in mind, however, that the state has rules and regulations regarding these types of transactions. It's wise to be fully aware of all rules and regulations prior to taking any action so that you can be sure you comply with all applicable laws.

How much of a life insurance policy Marion do I need?

The amount of life insurance coverage you need is a personal decision and largely depends on your lifestyle in Marion, AR. If you are single and have few dependents, you may only need to cover your final expenses. If you have multiple dependents such as a spouse, children, elderly parents, or student loan debt, then a more significant policy may be needed. You should consider your earning potential, debts, and future financial needs when determining the right amount of life insurance. It's best to consult with a financial advisor to find the best protection for your specific situation.

How does inflation impact my policy with life insurance near Marion?

Inflation can have a significant impact on your life insurance policy, particularly in Marion, AR. The cost of living in Marion can change rapidly, and the cost of a life insurance policy also fluctuates with the cost of living. Therefore, if the cost of living increases, the premiums for a life insurance policy increase as well. Therefore, to make sure you are not paying more than necessary for your policy, it is important to make sure the stated inflation rate in Marion is taken into account when setting policy premiums.

With a life insurance company Marion, am I eligible if I'm a smoker, drinker, or if I engage in high-risk activities?

Marion, AR residents can indeed get life insurance coverage even if they are a smoker, drinker, or engage in high-risk activities. However, depending on the amount of coverage they need, their rates may be higher than those of non-smokers and those who do not partake in activities that may put them at higher risks. To get the best rate, it is important for Marion, AR residents to be honest and upfront with their insurance companies and provide them with accurate information about their lifestyle habits.

Yes, Marion, AR residents can change the beneficiary listed on their life insurance policy. It is generally done with a simple amendment form that can be filled out and submitted to the insurance company. Most of the time, the insurance company will simply require the signature of the policyholder and any new beneficiary to make the change. Additionally, policies are often structured to give policyholders access to online account portals where they can make the beneficiary change electronically. In some cases, a life insurance policy owner may even be able to transfer the policy to a new beneficiary.

With life insurance policies near Marion, what should I do if my claim is denied?

If your life insurance claim is denied and you are located in Marion, AR., the next step would be to contact customer service or your agent. Most companies have a procedure in place for appealing a denied claim and Marion has several life insurance agencies at which to seek advice. Additionally, if the denial is due to the insurance company disputing an illness or disability mentioned in the application, you may consider consulting a local lawyer experienced in life insurance claims and denials. Furthermore, the Arkansas Insurance Department could assist you with the process of appealing the denial and provide other helpful resources regarding life insurance matters.

What is a life insurance rider, and what types of life insurance in Marion are available?

Life insurance riders are optional provisions that can be added to your life insurance policy to customize the coverage for your specific needs. In Marion, AR, some of the available riders include Waiver of Premium, an Accelerated Death Benefit, and a Children's Rider. Waiver of Premium allows eligible policy owners to waive paying premiums for a set period of time if they become disabled. The Accelerated Death Benefit is a built-in long-term care provider for individuals suffering from terminal or chronic illness. Finally, the Children's Rider provides life insurance coverage for one or more children below a certain age.

How does a group Marion life insurance policy through my employer work?

Group life insurance through an employer in Marion, AR works by providing coverage for all eligible employees in the group. This type of plan is typically provided by larger employers and is usually paid for wholly or in part by the employer. If enrolled in the plan, all eligible employees will receive a certain amount of life insurance coverage for a set period of time, usually without any extra cost to the employee. Beneficiaries are specified to receive any benefits that may be paid out should an employee pass away.

How do I compare life insurance quotes from a Marion life insurance company?

Comparing life insurance quotes in Marion, AR can be done both online and in person. For the most accurate comparison, it's best to speak with a licensed life insurance agent in Marion, AR. They will be able to go through your individual needs and assess the various options to determine which policy is best for you. Online tools are also available that compare multiple quotes side by side, allowing you to make an informed decision. These tools can quickly give you a sense of current market rates, ultimately helping you choose the most ideal policy for you and your family.

Compare Life Insurance Policies

Get started today and compare over 37 life insurance providers in as little as 15 minutes.

© 2024 PolicyHub - all rights reserved