Taking too long? Close loading screen.

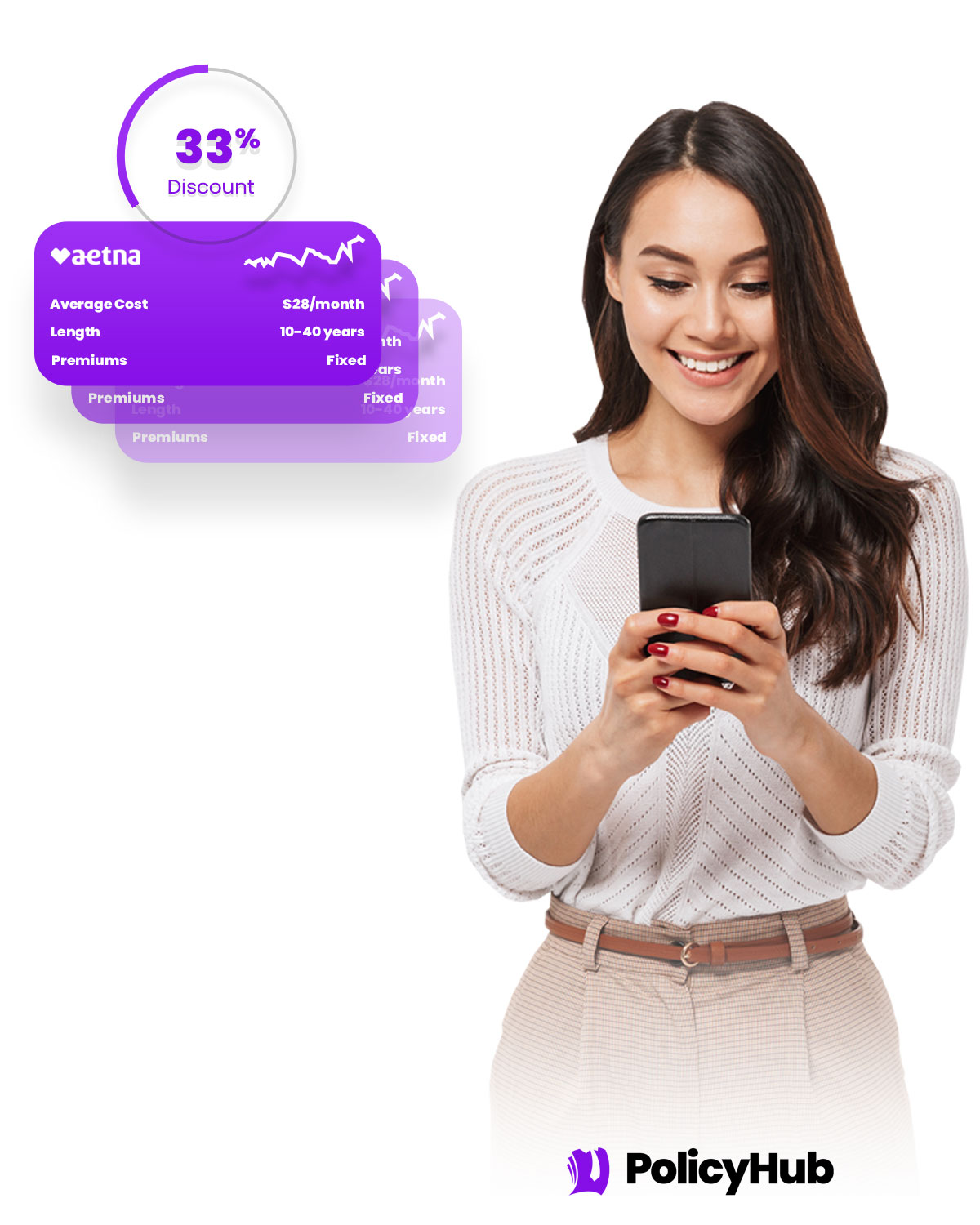

Compare over 20 life insurance policies in as little as 5 minutes.

With PolicyHub you get to compare over 20 life insurance policy providers in as little as 5 minutes. Save time. Save big. Get started now.

Compare over 20 top providers in Martinsville, VA

Your one-stop-shop to compare all the rates, all at once.

With PolicyHub you get:

Over 20 policy provider comparison.

Explore policies in Martinsville, VA from all the leading providers and choose the right one for you.

Locked in rate discount and exclusive deals.

Benefit from exclusive deals offered to residents in Martinsville, VA, and lock in rate discounts.

Customized policies just for you.

Our team tailors policies to Martinsville, VA residents, meaning optimal coverage at competitive rates.

"I was totally lost trying to find the right life insurance until I found PolicyHub. I was able to work with a licensed agent to compare all my options all at one. I got the perfect plan for me at a cheaper rate than I expected."

Barbara Winters

Policy Holder

ATTN: 2024 Martinsville, VA rates just released!

Get the latest insurance rates for 2024 and lock in your policy today! Get started comparing policies today.

Get the perfect plan with the cheapest rates in 3 easy steps.

Life insurance in Martinsville, VA Done in 3 easy steps

Step 1

Tell us about yourself.

Finding the perfect life insurance policy starts with answering a few questions to help us serve you better.

Step 2

Compare rates & plans with a pro.

Discuss your options with a licensed insurance agent. Compare different plans to find the best policy with the best rates.

Step 3

Lock in cheap rates.

Secure the lowest rates and lock in the perfect life insurance policy for you and your family.

"I lost hope trying to find a life insurance policy that wasn't insanely expensive. Thankfully PolicyHub helped me find the perfect policy that is affordable with high coverage. Thank you!"

Bill Barton

Policy Holder

PolicyHub is the smartest way to protect the people that matter most.

Safeguard Your Family

Life insurance means safeguarding your family in a worst-case scenario. Don't risk it.

Gain Peace of Mind

Far too many Americans are financially blindsided by the death of a loved one. But not your family.

Protect Your Business

Protect your business by ensuring a smooth transition of ownership with the right life insurance.

Beat Estate Taxes

Inheritance or estate taxes is burdensome for your heirs. A life insurance policy can help.

Invest in Your Future

For less than $1 per day, you can make a huge contribution to your family's financial safety.

Build Your Legacy

Through a life insurance policy, you can leave behind a legacy for your loved ones.

Get started in less than 5 minutes.

With PolicyHub getting started is easy. Compare all the rates from all the providers in Martinsville, VA. Get started in under 5 minutes.

All your life insurance needs in one place.

Term Life Insurance

Term insurance provides coverage for a set period of time, and it's a cost-efficient way to get the maximum coverage. It's an excellent solution for folks who have a temporary need for coverage.

Whole Life Insurance

Whole life insurance is coverage that lasts your entire life. This type of insurance also has a cash value component that grows over time, offering potential for financial growth along with lifelong coverage.

Universal Life Insurance

Universal life insurance is flexible coverage that lets you adjust your premiums and death benefits as your circumstances change throughout life. This flexibility makes it a popular choice.

No-Medical-Exam Life Insurance

No-medical-exam life insurance allows you to dodge the medical examination usually required for life insurance policies. It's perfect for individuals who want a swift approval process or have health concerns.

"Highly HIGHLY recommend PolicyHub if you need life insurance. They saved me sooo much time and money on my policy, it's nuts. Comparing all the providers at once is a game changer."

Chris Stephens

Policy Holder

Introducing PolicyHub Price Match Guarantee

Our priority is to save you money while getting you the right coverage. If you find a lower rate for a similar policy anywhere else, we'll match it! With PolicyHub, you can rest assured knowing you're getting the best price in Martinsville, VA.

Save time and get the best policy with the cheapest rates. Guaranteed.

|

Option 1 | Option 2 | ||

|---|---|---|---|---|

| 100% Digital | ||||

| Licensed Agents | ||||

| Expert Support | ||||

| Get Started in 5 Minutes | ||||

| Decades of Experience | ||||

| Compare 20+ Providers | ||||

| Zero Hidden Costs | ||||

| Top Insurance Providers |

"I knew I needed life insurance but I didn't know where to go. I talked with a few other companies but the cost was outrageous. I found PolicyHub and found the perfect plan for me at an affordable cost."

Wendy Smith

Policy Holder

Frequent Questions...

Deciding on the right life insurance policy for you and your family in Martinsville, VA can be a daunting task, but being prepared with some basic knowledge about different policies and options can help. First, understand your goals: what type of policy will best fit your family's needs? You should also find out how much coverage you need and how much you can afford to pay. Finally, research and compare policies to get the best coverage for the best price. A local financial advisor or insurance agent can help you decide.

What are the common policy exclusions from life insurance companies in Martinsville?

Residents of Martinsville, VA should be aware that some life insurance policies may include exclusions, which are factors or conditions that the insurance company will not cover. Common exclusions include coverage for hazardous activities, pre-existing conditions, or suicide within a certain period after purchase. Additionally, the policy may not cover death resulting from attempted suicide, wars, drug or alcohol abuse, and diseases excluded from the policy. It is important to be aware and informed of any exclusions so that you can make the best decisions for yourself and your family.

How much of a life insurance policy Martinsville do I need?

When deciding how much life insurance coverage you need in Martinsville, VA, it is important to consider factors like your financial obligations, size of family, age, and number of dependents. It is also important to think about how much you would need to pay for debts, such as a mortgage, and your family's current or future expenses. You may also want to factor in the money that you would like to leave to your beneficiaries. Ultimately, the best way to determine the amount of coverage that is right for you is to speak with an experienced life insurance agent in your area.

How do insurance companies assess risk with life insurance near Martinsville?

Insurance companies assess risk by evaluating multiple pieces of information when issuing a policy. In Martinsville, VA, insurers utilize various data points such as geographic location, age, credit score, and driving history to accurately assess the risk of an applicant. Moreover, they review other factors like medical and health history, lifestyle patterns, and education to determine the level of risk and decide which features to include in the policy. All of this information helps an insurance company choose the best rate for the person applying and determine the appropriate coverage needed to safeguard their assets.

Will a life insurance company Martinsville help me if I have a pre-existing medical condition?

Yes, in Martinsville, VA, you can get life insurance even if you have a pre-existing medical condition. While life insurance policies may offer decreased benefits or higher premiums, many companies in the area will offer a policy tailored to your individual health status. You can talk to an experienced life insurance agent or broker in the city for an assessment on what policies might be suitable for your specific needs. They will be able to explain different policies and benefits that cover your health condition in relation to insurance.

Yes, you can change the beneficiary of your life insurance policy if you live in Martinsville, VA. You should contact your local life insurance provider to guide you through the process. Before changing the beneficiary, you should understand the implications, such as potential taxation that may apply, and consider the financial impact of your choice. Additionally, it is important to note that the beneficiary should be updated on a regular basis to ensure it is relevant to your current situation and financial plan.

Do life insurance policies near Martinsville have any cash value?

Depending on the type of life insurance policy you have, there may be a cash value associated with your policy. Most permanent and some term policies come with a cash value component. Some life insurance providers in Martinsville, VA such as Nationwide and Prudential offer life insurance policies that accrue cash value over time. You will need to speak to a qualified agent to learn more about the cash value component of your particular type of policy.

What does 'level term' mean regarding life insurance in Martinsville?

Level term life insurance is a type of life insurance policy that provides a guaranteed death benefit to the policyholder's beneficiaries for a fixed number of years. In Martinsville, VA, level term life insurance coverage is often used to provide financial protection for families and to help pay off mortgage payments or other debt in the event of an untimely death. It is a cost-effective way for individuals to guarantee that certain financial obligations will be met in the event of their passing.

Can I get a Martinsville life insurance policy for my children?

Absolutely! Life insurance for your children is available in Martinsville, VA. With children’s life insurance, you can rest easy knowing that your child is protected in the event of a tragedy. Your policy can be tailored to fit your needs, and you can choose coverage amounts from a range of options. Plus, life insurance premiums are generally quite low for children, so it’s an affordable way to make sure you’re not putting any financial strain on yourself later in life.

What is the 'free look period' from a Martinsville life insurance company?

The 'free look period' is a law that applies to life insurance policies in Martinsville, Virginia and across the country. It allows consumers to review the policy terms and conditions and decide if it fits their needs. Within the first 10 30 days after the purchase of the policy, policy holders can decide to cancel without incurring any cancellation costs. If they do cancel, they will receive a full refund of all premiums paid. During this time, they are under no obligation to the insurer and can change their mind without additional costs.

Other locations near Martinsville, VA

Compare Life Insurance Policies

Get started today and compare over 37 life insurance providers in as little as 15 minutes.

© 2024 PolicyHub - all rights reserved