Taking too long? Close loading screen.

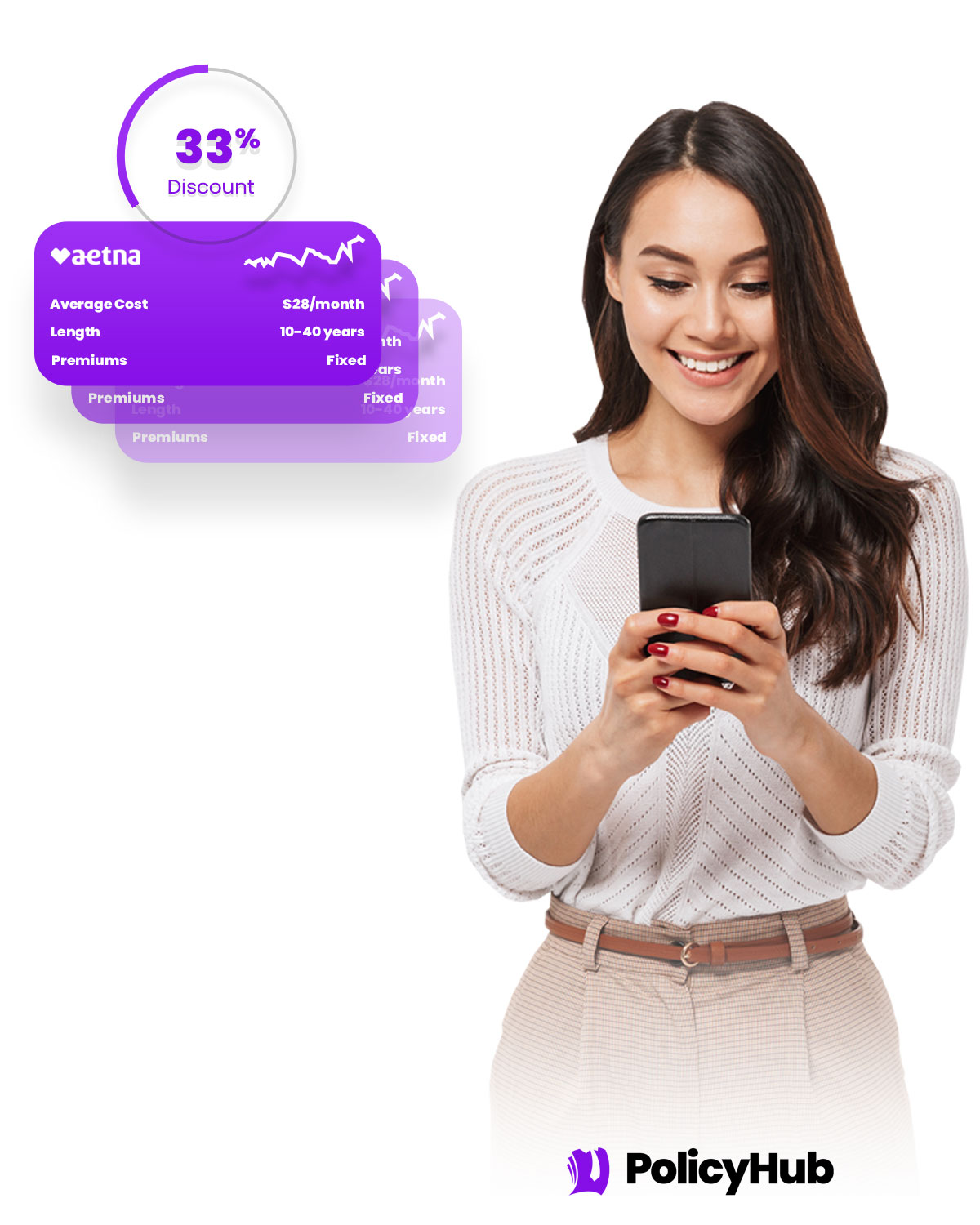

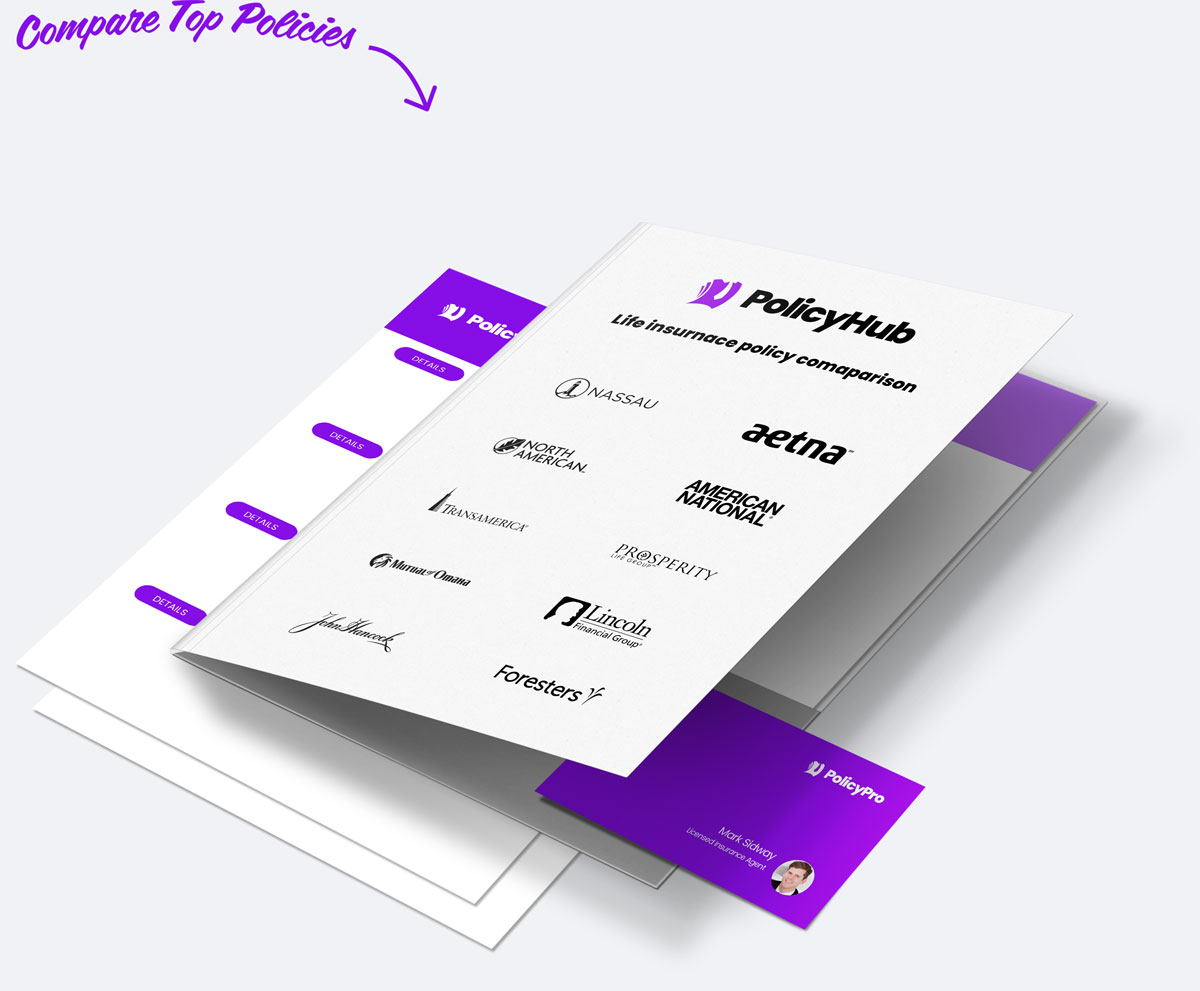

Compare over 20 life insurance policies in as little as 5 minutes.

With PolicyHub you get to compare over 20 life insurance policy providers in as little as 5 minutes. Save time. Save big. Get started now.

Compare over 20 top providers in Parma, OH

Your one-stop-shop to compare all the rates, all at once.

With PolicyHub you get:

Over 20 policy provider comparison.

Explore policies in Parma, OH from all the leading providers and choose the right one for you.

Locked in rate discount and exclusive deals.

Benefit from exclusive deals offered to residents in Parma, OH, and lock in rate discounts.

Customized policies just for you.

Our team tailors policies to Parma, OH residents, meaning optimal coverage at competitive rates.

"I was totally lost trying to find the right life insurance until I found PolicyHub. I was able to work with a licensed agent to compare all my options all at one. I got the perfect plan for me at a cheaper rate than I expected."

Barbara Winters

Policy Holder

ATTN: 2024 Parma, OH rates just released!

Get the latest insurance rates for 2024 and lock in your policy today! Get started comparing policies today.

Get the perfect plan with the cheapest rates in 3 easy steps.

Life insurance in Parma, OH Done in 3 easy steps

Step 1

Tell us about yourself.

Finding the perfect life insurance policy starts with answering a few questions to help us serve you better.

Step 2

Compare rates & plans with a pro.

Discuss your options with a licensed insurance agent. Compare different plans to find the best policy with the best rates.

Step 3

Lock in cheap rates.

Secure the lowest rates and lock in the perfect life insurance policy for you and your family.

"I lost hope trying to find a life insurance policy that wasn't insanely expensive. Thankfully PolicyHub helped me find the perfect policy that is affordable with high coverage. Thank you!"

Bill Barton

Policy Holder

PolicyHub is the smartest way to protect the people that matter most.

Safeguard Your Family

Life insurance means safeguarding your family in a worst-case scenario. Don't risk it.

Gain Peace of Mind

Far too many Americans are financially blindsided by the death of a loved one. But not your family.

Protect Your Business

Protect your business by ensuring a smooth transition of ownership with the right life insurance.

Beat Estate Taxes

Inheritance or estate taxes is burdensome for your heirs. A life insurance policy can help.

Invest in Your Future

For less than $1 per day, you can make a huge contribution to your family's financial safety.

Build Your Legacy

Through a life insurance policy, you can leave behind a legacy for your loved ones.

Get started in less than 5 minutes.

With PolicyHub getting started is easy. Compare all the rates from all the providers in Parma, OH. Get started in under 5 minutes.

All your life insurance needs in one place.

Term Life Insurance

Term insurance provides coverage for a set period of time, and it's a cost-efficient way to get the maximum coverage. It's an excellent solution for folks who have a temporary need for coverage.

Whole Life Insurance

Whole life insurance is coverage that lasts your entire life. This type of insurance also has a cash value component that grows over time, offering potential for financial growth along with lifelong coverage.

Universal Life Insurance

Universal life insurance is flexible coverage that lets you adjust your premiums and death benefits as your circumstances change throughout life. This flexibility makes it a popular choice.

No-Medical-Exam Life Insurance

No-medical-exam life insurance allows you to dodge the medical examination usually required for life insurance policies. It's perfect for individuals who want a swift approval process or have health concerns.

"Highly HIGHLY recommend PolicyHub if you need life insurance. They saved me sooo much time and money on my policy, it's nuts. Comparing all the providers at once is a game changer."

Chris Stephens

Policy Holder

Introducing PolicyHub Price Match Guarantee

Our priority is to save you money while getting you the right coverage. If you find a lower rate for a similar policy anywhere else, we'll match it! With PolicyHub, you can rest assured knowing you're getting the best price in Parma, OH.

Save time and get the best policy with the cheapest rates. Guaranteed.

|

Option 1 | Option 2 | ||

|---|---|---|---|---|

| 100% Digital | ||||

| Licensed Agents | ||||

| Expert Support | ||||

| Get Started in 5 Minutes | ||||

| Decades of Experience | ||||

| Compare 20+ Providers | ||||

| Zero Hidden Costs | ||||

| Top Insurance Providers |

"I knew I needed life insurance but I didn't know where to go. I talked with a few other companies but the cost was outrageous. I found PolicyHub and found the perfect plan for me at an affordable cost."

Wendy Smith

Policy Holder

Frequent Questions...

Choosing the right life insurance policy for you and your family is an important decision. If you live in Parma, OH, there are many local, independent insurance agents available to assist you in your search for the ideal policy. It's important to explain your needs to the agent, as they can offer you a variety of products to meet your needs. Be sure to provide any information about you, your family, and your specific financial goals in order to get an accurate estimate of the amount of coverage you'd need.

According to life insurance companies in Parma, what's the difference between term and whole life insurance?

The primary difference between term and whole life insurance is the duration of protection and the benefits available with each type of policy. Term life insurance policies provide coverage for a pre-determined period of time and do not accumulate a cash value. Typically, term life insurance policies in Parma, OH are the most affordable type of protection and provide the necessary life insurance coverage, but they offer no guarantees for family members after the policy is no longer in effect.

How much of a life insurance policy Parma do I need?

The amount of life insurance you need depends on your specific financial and family needs, which vary from person to person. In Parma, OH, some common considerations to keep in mind are your age, income, number of dependents, and overall financial obligations. Based on these factors, you can estimate a ballpark figure to determine how much life insurance coverage is right for you. Other considerations to bear in mind are potential tax liabilities, certain medical and healthcare bills, and any debts you may have. Ultimately, the goal is to provide adequate financial security for your loved ones in the event of your passing.

How can I lower my premiums with life insurance near Parma?

To lower your life insurance premiums in Parma, OH, it’s beneficial to check with different local providers to find the best rate. You can also consider adding or increasing your deductible, which could help you lower your yearly payments. Depending on what kind of life insurance policy you have, you could discuss other options such as reducing your coverage amount or shorten the term length. Taking positive steps to improve your health can also positively impact your premiums. Quitting smoking, eating better and being more active can help you get better rates.

Does a life insurance company Parma cover death due to accidents or suicide?

Yes, life insurance policies offered through Parma, OH providers typically cover death due to both accidents and suicide, depending on the type of coverage you select. To ensure you are adequately protected and covered for all of life’s unexpected events, it’s important to review the details and exclusions of your policy. You may also consider adding additional coverage to cover for accidental death and even other specific types of coverage in addition to that of the life insurance policy.

In Parma, OH, a contingent beneficiary is a person who is named to receive the death benefit from a life insurance policy in the event that the primary beneficiary is deceased or unable to receive the benefit for another reason. It's an important designation because, in the absence of a contingent beneficiary, the pay-out from the policy would need to go through probate, making it a lengthy and expensive process. Designating a contingent beneficiary allows the life insurance policy to be rapidly transferred in the event of the death of the primary beneficiary.

Are payouts from life insurance policies near Parma taxable?

In Parma, OH, the answer to whether or not a life insurance payout is taxable will depend on the policy. Generally, if the payout is from an employer-owned policy, then it is taxable, but if it is from an individually-owned policy or a private policy, then it is generally not taxable. Additionally, if the policy has been in place for more than two years, there may be no additional taxes, even if the policy is owned by an employer.

Regarding life insurance in Parma, what is policy surrender?

A life insurance policy surrender is the act of canceling a policy and receiving the expenditure value of the policy in a lump-sum payment. The cost of the life insurance policy in Parma, OH, would depend on factors such as age, gender, and health condition, among other factors. A life insurance policy surrender in Parma, OH would offer an opportunity to receive the surrender value in exchange for ending the policy. This is usually more advantageous than continuing a policy and paying premiums for coverage that may no longer be needed.

Can I get a Parma life insurance policy for my children?

Yes, you can get life insurance for your children in Parma, OH. Some of the life insurance policies available include whole life, term life, juvenile life, and universal life policies. These life insurance policies can provide financial security for your children, as well as provide them with coverage for their entire lifetime. Additionally, these policies can help create an estate for your children and provide them with financial protection. You may be able to purchase policy riders such as an accidental death benefit or coverage for a premature death, which will provide an extra layer of coverage for your children.

What should I look for in a Parma life insurance company?

When choosing a life insurance company in Parma, OH, it's important to look for a company with a proven track record of providing reliable coverage and excellent customer service. Additionally, you'll want to ensure the company you select offers a wide variety of options to choose from, so you can match the coverage you need to your specific lifestyle and budget. Also, it's important to consider any additional discounts or incentives a company may provide, such as online applications or discounts for bundling multiple policies.

Compare Life Insurance Policies

Get started today and compare over 37 life insurance providers in as little as 15 minutes.

© 2024 PolicyHub - all rights reserved