Taking too long? Close loading screen.

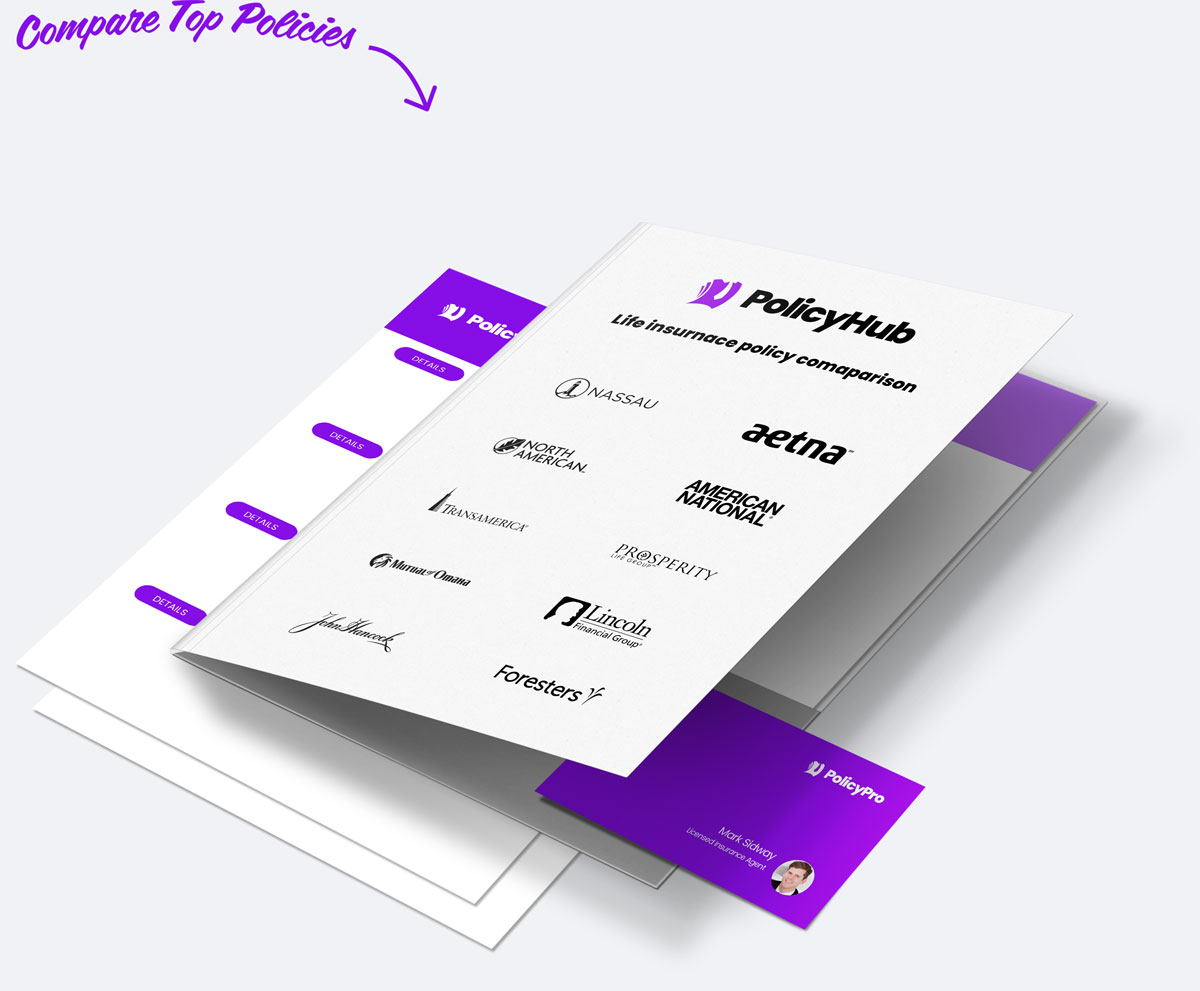

Compare over 20 life insurance policies in as little as 5 minutes.

With PolicyHub you get to compare over 20 life insurance policy providers in as little as 5 minutes. Save time. Save big. Get started now.

Compare over 20 top providers in Ridgefield, NJ

Your one-stop-shop to compare all the rates, all at once.

With PolicyHub you get:

Over 20 policy provider comparison.

Explore policies in Ridgefield, NJ from all the leading providers and choose the right one for you.

Locked in rate discount and exclusive deals.

Benefit from exclusive deals offered to residents in Ridgefield, NJ, and lock in rate discounts.

Customized policies just for you.

Our team tailors policies to Ridgefield, NJ residents, meaning optimal coverage at competitive rates.

"I was totally lost trying to find the right life insurance until I found PolicyHub. I was able to work with a licensed agent to compare all my options all at one. I got the perfect plan for me at a cheaper rate than I expected."

Barbara Winters

Policy Holder

ATTN: 2024 Ridgefield, NJ rates just released!

Get the latest insurance rates for 2024 and lock in your policy today! Get started comparing policies today.

Get the perfect plan with the cheapest rates in 3 easy steps.

Life insurance in Ridgefield, NJ Done in 3 easy steps

Step 1

Tell us about yourself.

Finding the perfect life insurance policy starts with answering a few questions to help us serve you better.

Step 2

Compare rates & plans with a pro.

Discuss your options with a licensed insurance agent. Compare different plans to find the best policy with the best rates.

Step 3

Lock in cheap rates.

Secure the lowest rates and lock in the perfect life insurance policy for you and your family.

"I lost hope trying to find a life insurance policy that wasn't insanely expensive. Thankfully PolicyHub helped me find the perfect policy that is affordable with high coverage. Thank you!"

Bill Barton

Policy Holder

PolicyHub is the smartest way to protect the people that matter most.

Safeguard Your Family

Life insurance means safeguarding your family in a worst-case scenario. Don't risk it.

Gain Peace of Mind

Far too many Americans are financially blindsided by the death of a loved one. But not your family.

Protect Your Business

Protect your business by ensuring a smooth transition of ownership with the right life insurance.

Beat Estate Taxes

Inheritance or estate taxes is burdensome for your heirs. A life insurance policy can help.

Invest in Your Future

For less than $1 per day, you can make a huge contribution to your family's financial safety.

Build Your Legacy

Through a life insurance policy, you can leave behind a legacy for your loved ones.

Get started in less than 5 minutes.

With PolicyHub getting started is easy. Compare all the rates from all the providers in Ridgefield, NJ. Get started in under 5 minutes.

All your life insurance needs in one place.

Term Life Insurance

Term insurance provides coverage for a set period of time, and it's a cost-efficient way to get the maximum coverage. It's an excellent solution for folks who have a temporary need for coverage.

Whole Life Insurance

Whole life insurance is coverage that lasts your entire life. This type of insurance also has a cash value component that grows over time, offering potential for financial growth along with lifelong coverage.

Universal Life Insurance

Universal life insurance is flexible coverage that lets you adjust your premiums and death benefits as your circumstances change throughout life. This flexibility makes it a popular choice.

No-Medical-Exam Life Insurance

No-medical-exam life insurance allows you to dodge the medical examination usually required for life insurance policies. It's perfect for individuals who want a swift approval process or have health concerns.

"Highly HIGHLY recommend PolicyHub if you need life insurance. They saved me sooo much time and money on my policy, it's nuts. Comparing all the providers at once is a game changer."

Chris Stephens

Policy Holder

Introducing PolicyHub Price Match Guarantee

Our priority is to save you money while getting you the right coverage. If you find a lower rate for a similar policy anywhere else, we'll match it! With PolicyHub, you can rest assured knowing you're getting the best price in Ridgefield, NJ.

Save time and get the best policy with the cheapest rates. Guaranteed.

|

Option 1 | Option 2 | ||

|---|---|---|---|---|

| 100% Digital | ||||

| Licensed Agents | ||||

| Expert Support | ||||

| Get Started in 5 Minutes | ||||

| Decades of Experience | ||||

| Compare 20+ Providers | ||||

| Zero Hidden Costs | ||||

| Top Insurance Providers |

"I knew I needed life insurance but I didn't know where to go. I talked with a few other companies but the cost was outrageous. I found PolicyHub and found the perfect plan for me at an affordable cost."

Wendy Smith

Policy Holder

Frequent Questions...

Life insurance is important for all individuals, especially those living in Ridgefield, NJ, due to the fact that it provides financial security for loved ones in the event of your death. Having life insurance in place can give peace of mind, knowing that your family will have a financial safety net. Additionally, Ridgefield is a desirable place to live, making it attractive to potential employers. With the added burden of taxes and property values that come with living in Ridgefield, having adequate life insurance can help protect your family against any future financial risks.

Can life insurance policies be transferred or sold with life insurance companies in Ridgefield?

In Ridgefield, NJ, life insurance policies can indeed be transferred or sold. However, it's important to note that transferring a policy requires the insurer's written consent, as does any significant change in the policy's ownership or beneficiary designation. It's extremely important to contact an insurance lawyer to review the policy prior to any transfer or sale to prevent issues in the future. Additionally, New Jersey state law may affect transfers and sales of life insurance policies, so it's always best to thoroughly research these rules before beginning the process.

How much of a life insurance policy Ridgefield do I need?

It is not possible to provide a definitive answer to the question of how much life insurance coverage one needs without taking into consideration the individual's circumstances. In order to properly determine the required level of life insurance coverage, your unique needs must be assessed. This is true no matter where you live, including Ridgefield, NJ. Age, family size, assets, current income, and other factors all come into play. It is recommended to speak with a life insurance professional to help determine an appropriate level of life insurance coverage for your needs.

How can I lower my premiums with life insurance near Ridgefield?

Amidst the increasing cost of life insurance premiums, Ridgefield, NJ residents can examine and purchase policies from a variety of independent providers. Shopping around can help you find the lowest rate that meets your needs. Additionally, you can also look into evaluating your coverage—if you increase the deductible, for instance, the insurance provider may be willing to reduce your monthly payments. To further lower your premiums, you may want to avail yourself of the many discounts being offered—ranging from group rates to veteran discounts—as these can make a significant impact on the rates you pay.

Will a life insurance company Ridgefield help me if I have a pre-existing medical condition?

Yes, you can get life insurance with a pre-existing medical condition in Ridgefield, NJ. Whether you are local or your policy is in another state, there are options available. Many life insurance companies offer specialized coverage for those with pre-existing medical conditions. Additionally, in the state of New Jersey, there is a health insurance risk pool established for people who have been denied coverage due to their pre-existing conditions. The New Jersey State Health Benefits Program and the School Employees’ Health Benefits Program alongside numerous life insurance companies provide reasonable rates to those with pre-existing conditions.

If your named beneficiary for your life insurance policy passes away before you do in Ridgefield, NJ, you will need to update your policy to name a new beneficiary. Before doing so, it is important to understand exactly how the policy defines your designated beneficiary; as policies can vary, the definitions and pay-out processes can differ. Your insurer may have specific requirements for filing the claim and naming a new beneficiary, so it is important to review the terms of your policy and to contact your insurance provider to ensure that your policy is accurately updated.

With life insurance policies near Ridgefield, what should I do if my claim is denied?

If your life insurance claim is denied in Ridgefield, NJ, first, you should review the denial to understand the reason why. Next, you can speak with your insurance company to discuss the denial and any options available to you to appeal the decision. You can also speak with an attorney in the area familiar with insurance policies and the claims process. Additionally, you can visit your local department of insurance for information on the insurance claims process and to confirm that your rights aren’t being violated.

What is a life insurance rider, and what types of life insurance in Ridgefield are available?

A life insurance rider is an exclusion, provision, or benefit that can be added to an existing life insurance policy to customize coverage. In Ridgefield, NJ, some of the available life insurance riders include Waiver of Premium, Accelerated Death Benefit, Child Rider, and Spouse Rider. The Waiver of Premium Rider waives the policy's premium payments if the insured becomes disabled. The Accelerated Death Benefit Rider provides an advance of life insurance benefits to the insured while he or she is still alive.

What is an accidental death and dismemberment Ridgefield life insurance policy?

An Accidental Death and Dismemberment (AD&D) insurance policy is a form of financial protection for individuals and families in the event of an untimely and unexpected death due to an accident. This policy is available to residents of Ridgefield, NJ and can provide financial compensation in the event of death or certain disabilities due to an accident. AD&D coverage varies, but often includes things such as funeral expenses and other costs associated with loss of life or injuries caused by an accident.

How can I check if a Ridgefield life insurance company is legitimate?

To check if a life insurance company is legitimate in Ridgefield, NJ, the best practice is to do research on their website, customer reviews, and to consult with local insurance agents. It is important to make sure the company that offers the product is licensed and the policy is backed by a valid and current insurance provider. Additionally, educated consumers should also check with their state's Department of Insurance and the Better Business Bureau (BBB) for scam alerts, complaint history, and other valuable information. Finally, you can ask questions about the product, coverage, and company before making any decisions.

Compare Life Insurance Policies

Get started today and compare over 37 life insurance providers in as little as 15 minutes.

© 2024 PolicyHub - all rights reserved