Taking too long? Close loading screen.

Compare over 20 life insurance policies in as little as 5 minutes.

With PolicyHub you get to compare over 20 life insurance policy providers in as little as 5 minutes. Save time. Save big. Get started now.

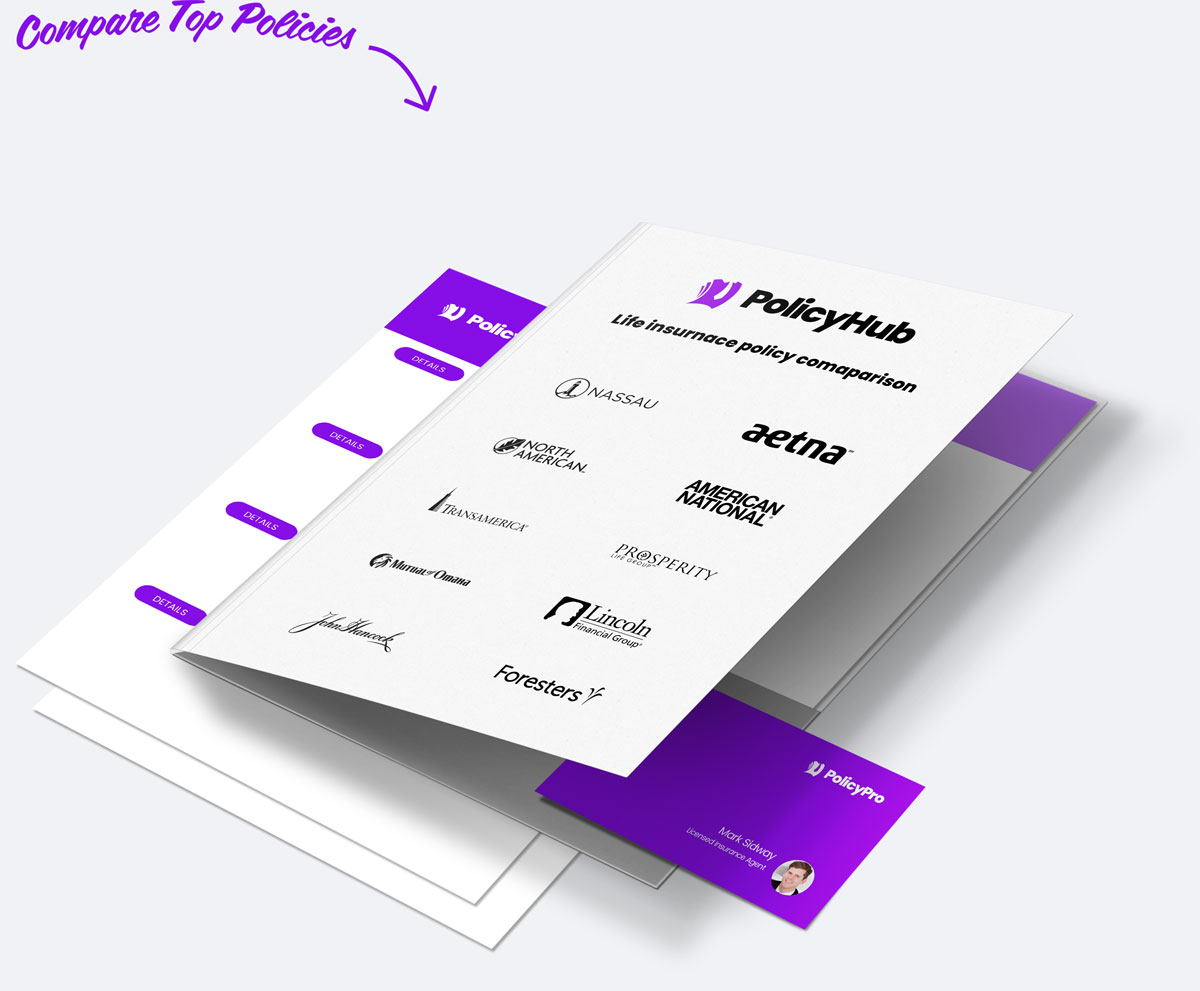

Compare over 20 top providers in San Francisco, CA

Your one-stop-shop to compare all the rates, all at once.

With PolicyHub you get:

Over 20 policy provider comparison.

Explore policies in San Francisco, CA from all the leading providers and choose the right one for you.

Locked in rate discount and exclusive deals.

Benefit from exclusive deals offered to residents in San Francisco, CA, and lock in rate discounts.

Customized policies just for you.

Our team tailors policies to San Francisco, CA residents, meaning optimal coverage at competitive rates.

"I was totally lost trying to find the right life insurance until I found PolicyHub. I was able to work with a licensed agent to compare all my options all at one. I got the perfect plan for me at a cheaper rate than I expected."

Barbara Winters

Policy Holder

ATTN: 2024 San Francisco, CA rates just released!

Get the latest insurance rates for 2024 and lock in your policy today! Get started comparing policies today.

Get the perfect plan with the cheapest rates in 3 easy steps.

Life insurance in San Francisco, CA Done in 3 easy steps

Step 1

Tell us about yourself.

Finding the perfect life insurance policy starts with answering a few questions to help us serve you better.

Step 2

Compare rates & plans with a pro.

Discuss your options with a licensed insurance agent. Compare different plans to find the best policy with the best rates.

Step 3

Lock in cheap rates.

Secure the lowest rates and lock in the perfect life insurance policy for you and your family.

"I lost hope trying to find a life insurance policy that wasn't insanely expensive. Thankfully PolicyHub helped me find the perfect policy that is affordable with high coverage. Thank you!"

Bill Barton

Policy Holder

PolicyHub is the smartest way to protect the people that matter most.

Safeguard Your Family

Life insurance means safeguarding your family in a worst-case scenario. Don't risk it.

Gain Peace of Mind

Far too many Americans are financially blindsided by the death of a loved one. But not your family.

Protect Your Business

Protect your business by ensuring a smooth transition of ownership with the right life insurance.

Beat Estate Taxes

Inheritance or estate taxes is burdensome for your heirs. A life insurance policy can help.

Invest in Your Future

For less than $1 per day, you can make a huge contribution to your family's financial safety.

Build Your Legacy

Through a life insurance policy, you can leave behind a legacy for your loved ones.

Get started in less than 5 minutes.

With PolicyHub getting started is easy. Compare all the rates from all the providers in San Francisco, CA. Get started in under 5 minutes.

All your life insurance needs in one place.

Term Life Insurance

Term insurance provides coverage for a set period of time, and it's a cost-efficient way to get the maximum coverage. It's an excellent solution for folks who have a temporary need for coverage.

Whole Life Insurance

Whole life insurance is coverage that lasts your entire life. This type of insurance also has a cash value component that grows over time, offering potential for financial growth along with lifelong coverage.

Universal Life Insurance

Universal life insurance is flexible coverage that lets you adjust your premiums and death benefits as your circumstances change throughout life. This flexibility makes it a popular choice.

No-Medical-Exam Life Insurance

No-medical-exam life insurance allows you to dodge the medical examination usually required for life insurance policies. It's perfect for individuals who want a swift approval process or have health concerns.

"Highly HIGHLY recommend PolicyHub if you need life insurance. They saved me sooo much time and money on my policy, it's nuts. Comparing all the providers at once is a game changer."

Chris Stephens

Policy Holder

Introducing PolicyHub Price Match Guarantee

Our priority is to save you money while getting you the right coverage. If you find a lower rate for a similar policy anywhere else, we'll match it! With PolicyHub, you can rest assured knowing you're getting the best price in San Francisco, CA.

Save time and get the best policy with the cheapest rates. Guaranteed.

|

Option 1 | Option 2 | ||

|---|---|---|---|---|

| 100% Digital | ||||

| Licensed Agents | ||||

| Expert Support | ||||

| Get Started in 5 Minutes | ||||

| Decades of Experience | ||||

| Compare 20+ Providers | ||||

| Zero Hidden Costs | ||||

| Top Insurance Providers |

"I knew I needed life insurance but I didn't know where to go. I talked with a few other companies but the cost was outrageous. I found PolicyHub and found the perfect plan for me at an affordable cost."

Wendy Smith

Policy Holder

Frequent Questions...

In San Francisco, CA, there are many different types of life insurance to choose from. These can include term life, whole life, universal life, and variable universal life insurance. Term life insurance provides coverage for a set amount of time, allowing you to choose the length of time and amount of coverage to best meet your needs. Whole life insurance is intended to stay with you for your whole life and builds cash value over time. Universal life insurance is a flexible form of protection that offers death benefit protection along with tax-deferred cash accumulation.

What are the common policy exclusions from life insurance companies in San Francisco?

Common exclusions in a life insurance policy in San Francisco, CA can include suicide, participating in criminal activities, risky occupations, and hazardous pastimes. Many policies will also include limitations on the policy's coverage if a medical condition is preexisting. Depending on the type of life insurance policy, some policies may also include limitations for pre-existing health conditions, drug or alcohol use, and other dangerous activities. In some cases, the insurance company may require additional exclusions in a policy if there is a high risk for the policyholder.

What happens if I stop paying premiums on my life insurance policy San Francisco?

If you stop paying premiums on your life insurance policy in San Francisco, CA, you risk your policy lapsing. Over time, your policy will decrease in its value. In some cases, a policy may lapse after a few months of missed payments. If this happens, you will no longer be covered, and you may be responsible for any premiums previously paid for the policy. Furthermore, depending on the exact circumstances, there may be tax implications associated with lapsing the policy.

How do insurance companies assess risk with life insurance near San Francisco?

Insurance companies assess risk when issuing a policy in San Francisco, CA by evaluating a variety of factors. Companies may consider the type of coverage selected, the number of claims filed in recent years, the maximum value of coverage purchased, and any changes in the insured’s credit history. San Francisco-specific considerations might include specialized dangers such as wildfires, earthquakes, and sea level rise due to climate change. Additionally, insurance companies will also look into the value of the property or asset being insured and the neighborhood it’s located in.

Does a life insurance company San Francisco cover death due to accidents or suicide?

Life insurance policies vary from state to state, so it's important to be aware of the specific coverage you have in California. In San Francisco, life insurance policies typically cover death due to accidents or suicide, provided they are not caused by an excluded act. It's important to review your policy closely to understand the full extent of the coverage and any exclusions that may be listed. To ensure that your policy provides the coverage you need, consider working with an independent life insurance professional in San Francisco.

In San Francisco, CA, yes, you can certainly name more than one beneficiary for your life insurance policy. This is a great option as it allows you to distribute your life insurance policy between multiple persons. For example, you can name multiple family members, friends, or even charities as beneficiaries. In order to add more than one beneficiary, you may need to contact your life insurance provider. They can guide you through the steps and provide any assistance you may need in establishing additional beneficiaries.

What happens to life insurance policies near San Francisco if I outlive the term?

If you are located in San Francisco, CA, and you outlive the term of your life insurance policy, the policy itself will remain in effect until the policy's designated date of termination. Typically the policy will expire due to the end of the policy period, but if you outlive the term of the policy, the policy will remain valid until the termination date or the death of the insured, whichever comes first. In short, you won't have to worry about losing your coverage if you are still alive when the term of the policy ends.

Regarding life insurance in San Francisco, what is policy surrender?

A life insurance policy surrender in San Francisco, CA allows policyholders to receive a payment of the value of their policy, or "cash surrender value", less any surrender charges and fees. This payment is typically lower than the policy's death benefit and can often take up to 45 days to be processed. It's important for potential policyholders in San Francisco to consider if surrendering a policy is the best choice for their financial situation, as it may have adverse results in terms of taxes.

Can I get a San Francisco life insurance policy for my children?

Yes, you can get life insurance for your children in San Francisco, CA. There are many insurance providers that offer a variety of plans to fit your specific needs and budget. Each plan can provide coverage for your minor children, guaranteeing they will be taken care of in the event of your unexpected death or disability. When searching for the right policy, take advantage of the experts located in San Francisco to ensure you choose a plan that meets your needs. The goal is to make sure you and your family are covered and protected against life's unpredictable circumstances.

How can I check if a San Francisco life insurance company is legitimate?

To check if a life insurance company is legitimate, you should research their licensing status and check whether they are an active member of the National Association of Insurance Commissioners (NAIC). Your local insurance commissioner in San Francisco, CA can help with this information. It is also beneficial to review online reviews, investigate their financial solvency, and find out if they have any unresolved consumer complaints. Finally, you should ask a professional insurance agent who has experience and expertise in this field.

Compare Life Insurance Policies

Get started today and compare over 37 life insurance providers in as little as 15 minutes.

© 2024 PolicyHub - all rights reserved