Taking too long? Close loading screen.

Compare over 20 life insurance policies in as little as 5 minutes.

With PolicyHub you get to compare over 20 life insurance policy providers in as little as 5 minutes. Save time. Save big. Get started now.

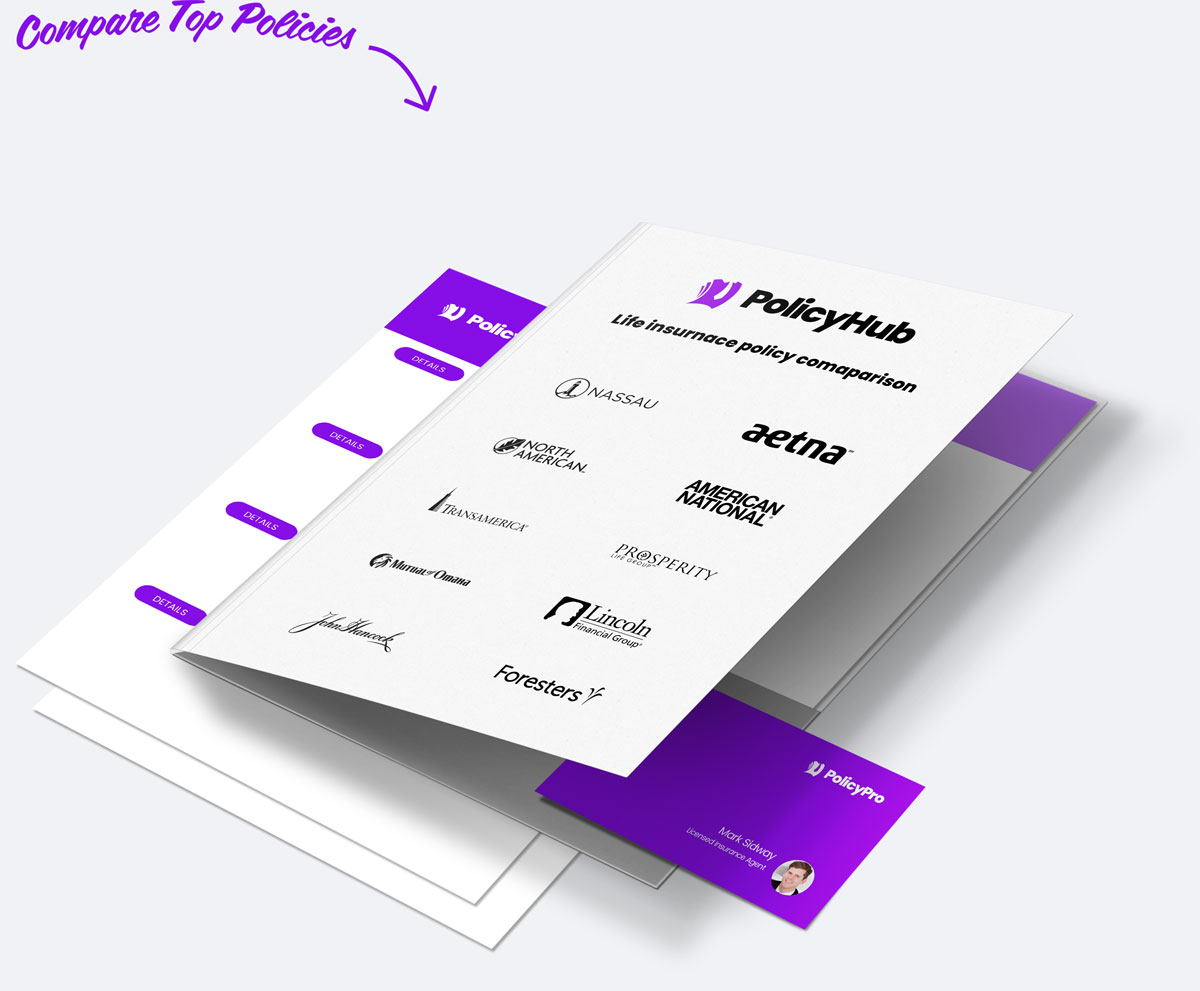

Compare over 20 top providers in Westfield, MA

Your one-stop-shop to compare all the rates, all at once.

With PolicyHub you get:

Over 20 policy provider comparison.

Explore policies in Westfield, MA from all the leading providers and choose the right one for you.

Locked in rate discount and exclusive deals.

Benefit from exclusive deals offered to residents in Westfield, MA, and lock in rate discounts.

Customized policies just for you.

Our team tailors policies to Westfield, MA residents, meaning optimal coverage at competitive rates.

"I was totally lost trying to find the right life insurance until I found PolicyHub. I was able to work with a licensed agent to compare all my options all at one. I got the perfect plan for me at a cheaper rate than I expected."

Barbara Winters

Policy Holder

ATTN: 2024 Westfield, MA rates just released!

Get the latest insurance rates for 2024 and lock in your policy today! Get started comparing policies today.

Get the perfect plan with the cheapest rates in 3 easy steps.

Life insurance in Westfield, MA Done in 3 easy steps

Step 1

Tell us about yourself.

Finding the perfect life insurance policy starts with answering a few questions to help us serve you better.

Step 2

Compare rates & plans with a pro.

Discuss your options with a licensed insurance agent. Compare different plans to find the best policy with the best rates.

Step 3

Lock in cheap rates.

Secure the lowest rates and lock in the perfect life insurance policy for you and your family.

"I lost hope trying to find a life insurance policy that wasn't insanely expensive. Thankfully PolicyHub helped me find the perfect policy that is affordable with high coverage. Thank you!"

Bill Barton

Policy Holder

PolicyHub is the smartest way to protect the people that matter most.

Safeguard Your Family

Life insurance means safeguarding your family in a worst-case scenario. Don't risk it.

Gain Peace of Mind

Far too many Americans are financially blindsided by the death of a loved one. But not your family.

Protect Your Business

Protect your business by ensuring a smooth transition of ownership with the right life insurance.

Beat Estate Taxes

Inheritance or estate taxes is burdensome for your heirs. A life insurance policy can help.

Invest in Your Future

For less than $1 per day, you can make a huge contribution to your family's financial safety.

Build Your Legacy

Through a life insurance policy, you can leave behind a legacy for your loved ones.

Get started in less than 5 minutes.

With PolicyHub getting started is easy. Compare all the rates from all the providers in Westfield, MA. Get started in under 5 minutes.

All your life insurance needs in one place.

Term Life Insurance

Term insurance provides coverage for a set period of time, and it's a cost-efficient way to get the maximum coverage. It's an excellent solution for folks who have a temporary need for coverage.

Whole Life Insurance

Whole life insurance is coverage that lasts your entire life. This type of insurance also has a cash value component that grows over time, offering potential for financial growth along with lifelong coverage.

Universal Life Insurance

Universal life insurance is flexible coverage that lets you adjust your premiums and death benefits as your circumstances change throughout life. This flexibility makes it a popular choice.

No-Medical-Exam Life Insurance

No-medical-exam life insurance allows you to dodge the medical examination usually required for life insurance policies. It's perfect for individuals who want a swift approval process or have health concerns.

"Highly HIGHLY recommend PolicyHub if you need life insurance. They saved me sooo much time and money on my policy, it's nuts. Comparing all the providers at once is a game changer."

Chris Stephens

Policy Holder

Introducing PolicyHub Price Match Guarantee

Our priority is to save you money while getting you the right coverage. If you find a lower rate for a similar policy anywhere else, we'll match it! With PolicyHub, you can rest assured knowing you're getting the best price in Westfield, MA.

Save time and get the best policy with the cheapest rates. Guaranteed.

|

Option 1 | Option 2 | ||

|---|---|---|---|---|

| 100% Digital | ||||

| Licensed Agents | ||||

| Expert Support | ||||

| Get Started in 5 Minutes | ||||

| Decades of Experience | ||||

| Compare 20+ Providers | ||||

| Zero Hidden Costs | ||||

| Top Insurance Providers |

"I knew I needed life insurance but I didn't know where to go. I talked with a few other companies but the cost was outrageous. I found PolicyHub and found the perfect plan for me at an affordable cost."

Wendy Smith

Policy Holder

Frequent Questions...

Life insurance is an important way to protect one’s family and assets, particularly in Westfield, MA. It ensures that should an unexpected tragedy occur, one's family can still be financially secure. Even if you anticipate never needing life insurance, it can provide peace of mind and a back-up plan for your loved ones if something were to happen. Through life insurance, your family may maintain the lifestyle they are accustomed to, ensuring that your loved ones will be taken care of in the event of a loss.

Can life insurance policies be transferred or sold with life insurance companies in Westfield?

Yes, life insurance policies can be transferred or sold in Westfield, MA. The process for transferring or selling will depend upon the specific life insurance policy being transferred or sold. Generally, selling a life insurance policy will require the policyholder to submit a copy of the original policy contract and a request to transfer the life insurance policy to the buyer. Depending upon the rules and regulations applicable to the life insurance policy, Westfield, MA policyholders will usually need to provide the buyer with evidence of ownership.

How much of a life insurance policy Westfield do I need?

The amount of life insurance you need to buy depends on a number of factors, including your current lifestyle, income and family size. For example, if you live in Westfield, MA, and have a spouse and two children, you may need enough coverage to provide a cushion of financial security and peace of mind for your loved ones in the case of your untimely death. To help determine the right amount of coverage for you, consider consulting with a qualified financial advisor in Westfield, MA or another nearby city.

How does inflation impact my policy with life insurance near Westfield?

Inflation has a direct impact on life insurance policy holders in Westfield, MA. As the cost of living increases, it is likely that the amount of life insurance coverage that one currently has may not be enough to protect their loved ones in light of these changes. In Westfield, MA, it's wise to review your life insurance policy periodically to see if the coverage is still adequate.

Do I need a medical exam to contact a life insurance company Westfield?

Depending on the type of life insurance policy, you may need to get a medical exam to get life insurance in Westfield, MA. Whole life, universal life and certain types of term life insurance policies typically require a medical exam, while other policies do not. If you choose a policy that requires a medical exam, you will be assigned an examiner who will be responsible for collecting and analyzing your health information. Be sure to find an examiner that is within a reasonable distance of Westfield so that you can easily get your exam done.

Your life insurance policy through Westfield, MA is designed to protect you and your family in the event of your death. Thus, if your beneficiary predeceases you, your life insurance policy will not expire and the proceeds will not be forfeited. Instead, the life insurance proceeds will generally be paid to your estate or to a court-appointed administrator. This will enable the proceeds to be distributed according to the wishes you have expressed in your will. Therefore, it is important to update your beneficiary status whenever you experience a major life event, such as the death of your beneficiary.

What happens to life insurance policies near Westfield if I outlive the term?

If you live past the term of your life insurance policy in Westfield, MA, the policy will typically become void and you will no longer be covered under the policy. If your policy contains a term-to-age conversion clause, however, your policy will automatically convert to a Permanent policy at the end of the term and the death benefit of your policy will remain in effect as long as premiums are paid. Additionally, some policies may provide cash value features such as dividends or loans against the policy that would enable you to keep some of the money you have contributed to your policy.

Can I borrow against my life insurance in Westfield?

Yes, you can potentially borrow against your life insurance policy in Westfield, MA. Certain types of life insurance policies, such as Universal Life insurance policies, offer you the option to borrow cash against the current cash value of the policy. If you choose to do so, it’s important to remember that the loan will accrue interest, and as such, this reduces the amount of the total death benefit. Therefore, it’s important to always carefully consider the pros and cons of any borrowing decision before committing to the loan.

Is a Westfield life insurance policy through work enough?

Whether life insurance offered through your workplace in Westfield, MA is enough depends on your particular financial and family situation. It is wise to take into account things like whether you have dependents that need to be taken care of in the event of your passing, as well as your overall financial commitments. An independent financial planner or insurance agent can help you determine if your work-provided life insurance is sufficient for your needs. Additionally, it may be beneficial to supplement your work-provided coverage with a private policy.

How do I compare life insurance quotes from a Westfield life insurance company?

If you live in Westfield, MA and you are interested in comparing life insurance quotes, you should reach out to a trusted, local insurance agency. At Westfield Insurance, our experienced agents can provide you with personalized quotes tailored to your specific needs. We make it easy to compare different options and coverage levels so you can choose the policy that is right for you. Plus, we are always available to answer any questions you may have about the options available to you. Call us today for a free consultation and let us help you find the life insurance policy that fits your budget and coverage level.

Other locations near Westfield, MA

Compare Life Insurance Policies

Get started today and compare over 37 life insurance providers in as little as 15 minutes.

© 2024 PolicyHub - all rights reserved