Taking too long? Close loading screen.

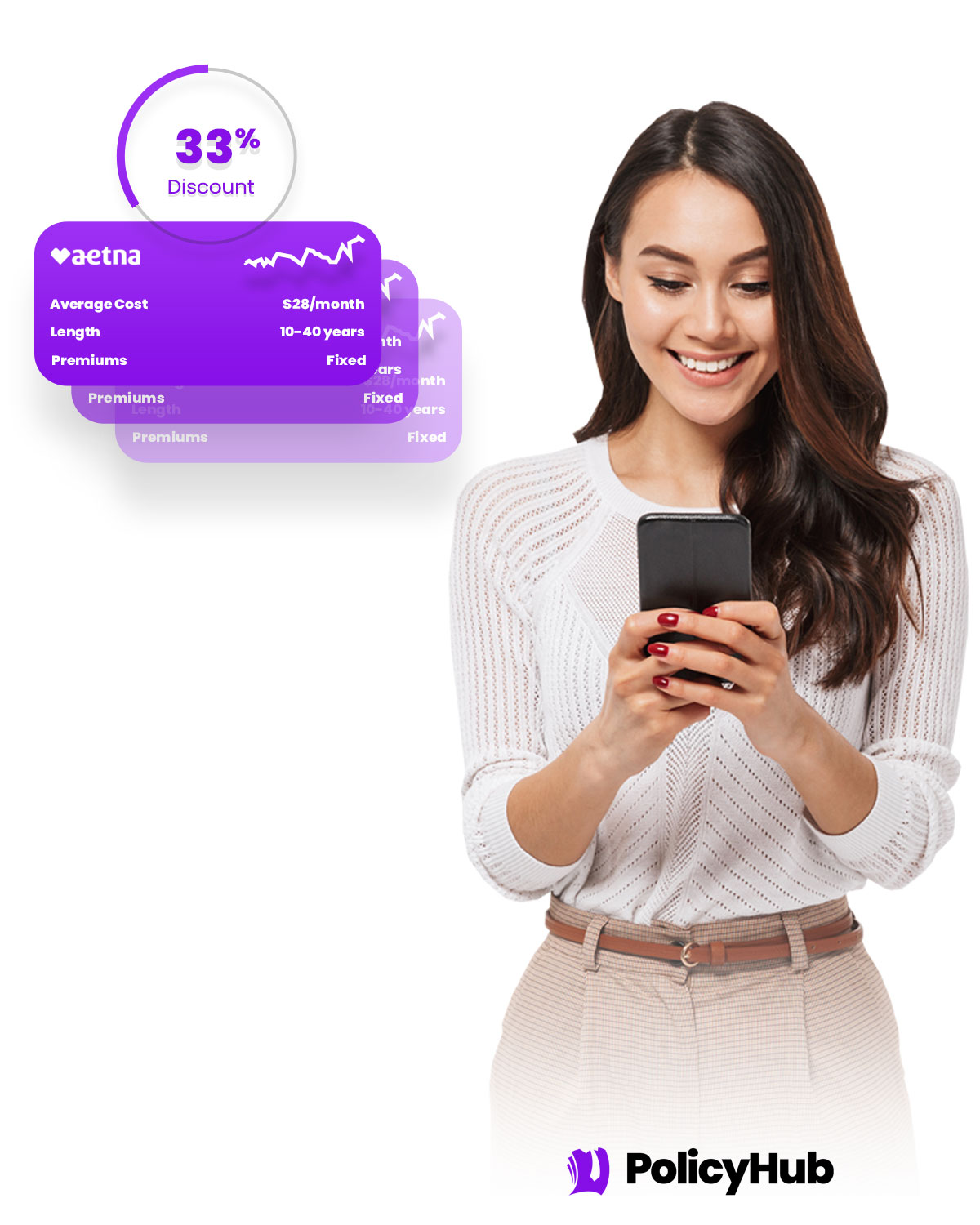

Compare over 20 mortgage insurance policies in as little as 5 minutes.

With PolicyHub you get to compare over 20 mortgage insurance policy providers in as little as 5 minutes. Save time. Save big. Get started now.

Compare over 20 top providers in Glenn Heights, TX

Your one-stop-shop to compare all the rates, all at once.

With PolicyHub you get:

Over 20 policy provider comparison.

Explore multiple Glenn Heights, TX policies from all the leading insurers and choose the one that fits your needs.

Locked in rate discount and exclusive deals.

Benefit from exclusive deals offered only to residents of your state, and lock in huge rate discounts.

Customized policies just for you.

Our team tailors policies to your unique needs, meaning optimal coverage at competitive rates.

"I was totally lost trying to find the right mortgage insurance until I found PolicyHub. I was able to work with a licensed agent to compare all my options all at one. I got the perfect plan for me at a cheaper rate than I expected."

Barbara Winters

Policy Holder

ATTN: 2024 rates just released!

Get the latest mortgage insurance rates for 2024 and lock in your policy today! Get started comparing policies today.

Get the perfect plan with the cheapest rates in 3 easy steps.

Done in 3 easy steps

Step 1

Tell us about yourself.

Finding the perfect mortgage insurance policy starts with answering a few questions to help us serve you better.

Step 2

Compare rates & plans with a pro.

Discuss your options with a licensed insurance agent. Compare different plans to find the best policy with the cheapest rates.

Step 3

Lock in cheap rates.

Secure the lowest rates and lock in the perfect mortgage insurance policy for you and your family.

"I lost hope trying to find a mortgage insurance policy that wasn't insanely expensive. Thankfully PolicyHub helped me find the perfect policy that is affordable with high coverage. Thank you!"

Bill Barton

Policy Holder

PolicyHub is the smartest way to protect the people that matter most.

Safeguard Your Family

Mortgage insurance means safeguarding your family in a worst-case scenario. Don't risk it.

Gain Peace of Mind

Far too many Americans are financially blindsided by the death of a loved one. But not your family.

Protect Your Business

Protect your business by ensuring a smooth transition of ownership with the right mortgage insurance.

Beat Estate Taxes

Inheritance or estate taxes is burdensome for your heirs. A mortgage insurance policy can help.

Invest in Your Future

For less than $1 per day, you can make a huge contribution to your family's financial safety.

Build Your Legacy

Through a mortgage insurance policy, you can leave behind a legacy for your loved ones.

Get started in less than 5 minutes.

With PolicyHub getting started is easy. Compare all the rates from all the providers. Get started in under 5 minutes.

All your mortgage insurance needs in one place.

Private Mortgage Insurance (PMI)

PMI is your solution for buying a home with less than 20% down. It protects your lender, but also enables you to own a home sooner with less upfront cash. It's added seamlessly to your monthly mortgage payments.

FHA Mortgage Insurance Premium (MIP)

FHA's MIP is ideal for those with less-than-perfect credit scores. With an upfront premium and a smaller annual premium, MIP makes homeownership more attainable for a broad range of buyers.

USDA Mortgage Insurance

USDA Mortgage Insurance is tailored for rural homebuyers. With a manageable upfront guarantee fee and a low annual fee, it's a cost-effective way to secure your countryside dream home.

VA Funding Fee

The VA Funding Fee, unique to VA home loans, is a one-time fee that helps sustain the VA loan program for future generations of military homeowners. Depending on your service history, you may even be exempt.

"Highly HIGHLY recommend PolicyHub if you need mortage insurance. They saved me sooo much time and money on my policy, it's nuts. Comparing all the providers at once is a game changer."

Chris Stephens

Policy Holder

Introducing PolicyHub Price Match Guarantee

Our priority is to save you money while getting you the right coverage. If you find a lower rate for a similar policy anywhere else, we'll match it! With PolicyHub, you can rest assured knowing you're getting the best price.

Save time and get the best policy with the cheapest rates. Guaranteed.

|

Option 1 | Option 2 | ||

|---|---|---|---|---|

| 100% Digital | ||||

| Licensed Agents | ||||

| Expert Support | ||||

| Get Started in 5 Minutes | ||||

| Decades of Experience | ||||

| Compare 20+ Providers | ||||

| Zero Hidden Costs | ||||

| Top Insurance Providers |

"I knew I needed mortgage insurance but I didn't know where to go. I talked with a few other companies but the cost was outrageous. I found PolicyHub and found the perfect plan for me at an affordable cost."

Wendy Smith

Policy Holder

Frequent Questions...

Mortgages are a large investment and mortgage insurance is important to protect homeowners from financial hardship in case of an unforeseen event. In Glenn Heights, TX, mortgage insurance provides an additional layer of protection from potential foreclosure and loss of home for those who are unable to make mortgage payments if an event like job loss, illness, or death of a breadwinner occurs. Mortgage insurance helps to keep families in their homes and also helps protect lenders in situations where the homeowner has defaulted on or is unable to repay the loan.

How does a larger down payment affect my Glenn Heights mortgage insurance policy cost?

In Glenn Heights, TX, a larger down payment can have a positive effect on your mortgage insurance cost. Generally, the larger the down payment made up front, the lower the interest rate you will be offered, resulting in lower monthly mortgage payments and possibly a lower mortgage insurance cost. Additionally, depending on the type of loan you are using, a larger down payment might also allow you to avoid any mortgage insurance costs altogether. Because the loan-to-value is lower when you make a larger down payment, many lenders may not require you to purchase private mortgage insurance (PMI).

What are the benefits of having a private mortgage insurance policy Glenn Heights?

In Glenn Heights, TX, private mortgage insurance (PMI) can provide important financial benefits in case of unexpected home ownership costs. PMI protects mortgage lenders in the event of a homeowner's financial hardship by giving them an extra layer of risk security. If a homeowner is unable to make their mortgage payments, PMI can help cover the payments so that the lender is not significantly affected by the financial loss. PMI also offers lower down payments, improved credit scores, and helps borrowers with less-than-perfect credit qualify for more financing options.

What are the benefits of FHA mortgage insurance near Glenn Heights?

FHA mortgage insurance offers major benefits to those living in Glenn Heights, TX, such as low down payments, lenient credit requirements, and competitive rates. The FHA insures the mortgage, protecting the lender in case of default. This insurance provides Glenn Heights home buyers with the ability to qualify for a loan they may not otherwise be able to secure. It also allows buyers to purchase a home with a 3.5% down payment, making it accessible to those with limited financial resources. FHA mortgage insurance also makes loan modification and refinancing easier.

Who is eligible for USDA insurance from Glenn Heights mortgage insurance companies?

Eligibility for USDA mortgage insurance in Glenn Heights, TX is determined by factors such as income eligibility and property location. To qualify, applicants must meet income limits and must have the ability to repay the loan. The property must also be located within an eligible rural area, and the property must also be occupied as the applicant’s primary residence. Additionally, applicants must demonstrate that they have been unable to obtain financing from other sources. Households must be without adequate housing and must have an acceptable credit history and the ability to afford the mortgage payments, taxes, and insurance premiums.

The VA Funding Fee in Glenn Heights, TX is typically two and a half percent of the loan amount for first-time homebuyers. For subsequent VA loans, the funding fee is three and a half percent. Depending on the veteran's service record, some may be exempt from paying this fee, including veterans with a service-connected disability, those who have received a Purple Heart, and veterans who served in certain countries. Veterans with no down payment or low down payment levels may also have higher funding fees.

What factors influence the cost of mortgage insurance in Glenn Heights?

In general, several factors can influence the cost of mortgage insurance in Glenn Heights, TX, such as the amount of the loan, the type and term of the loan, the loan-to-value ratio, the borrower's credit history, and the home's location, condition, and value. Additionally, lenders may have specific requirements or fees that could add to the cost of the mortgage insurance. Overall, the price of mortgage insurance is influenced by all of these components and may vary depending on the borrower's particular circumstances.

What process do I need to follow to cancel my Glenn Heights mortgage insurance policy?

Cancellation of a mortgage insurance policy in Glenn Heights, TX will require the homeowner to contact their loan servicer and fill out a Request for Mortgage Insurance Cancellation form. The homeowner may be required to submit documentation to prove that the outstanding mortgage balance is less than 78% of the home's market value or that the homeowner has a 20% equity stake in the home. Once the request has been approved, the servicer can provide the homeowner with a Certificate of Cancellation from the mortgage insurance company. The homeowner should keep this for their records.

What factors are considered when calculating mortgage insurance for a Glenn Heights mortgage insurance company?

When calculating mortgage insurance, there are several factors specific to Glenn Heights, TX, that must be taken into account. These factors include the value of the property in question, the length of the loan, the borrower's credit score, the debt-to-income ratio, and the area’s home price index. In addition, factors such as the borrower’s down payment amount and their purchase price-to-value ratio may also affect the rate of mortgage insurance. All of these items must be taken into account when determining the insurance rate for a loan in Glenn Heights, TX.

Can I opt out of services from mortgage insurance companies in Glenn Heights?

Yes, you may be able to opt out of mortgage insurance depending on the specific terms of your loan in Glenn Heights, TX. Generally, loans with less than 20% down payment require lenders to purchase mortgage insurance, which is a precautionary measure to protect the interests of the lender in case the borrower defaults. However, some lenders will offer an opt-out of mortgage insurance once the amount of the loan drops to 80% of the original appraised value or by increasing payments to meet the 20% equity goal sooner.

Other locations near Glenn Heights, TX

Compare Life Insurance Policies

Get started today and compare over 37 life insurance providers in as little as 15 minutes.

© 2024 PolicyHub - all rights reserved