Taking too long? Close loading screen.

Compare over 20 mortgage insurance policies in as little as 5 minutes.

With PolicyHub you get to compare over 20 mortgage insurance policy providers in as little as 5 minutes. Save time. Save big. Get started now.

Compare over 20 top providers in Marlborough, MA

Your one-stop-shop to compare all the rates, all at once.

With PolicyHub you get:

Over 20 policy provider comparison.

Explore multiple Marlborough, MA policies from all the leading insurers and choose the one that fits your needs.

Locked in rate discount and exclusive deals.

Benefit from exclusive deals offered only to residents of your state, and lock in huge rate discounts.

Customized policies just for you.

Our team tailors policies to your unique needs, meaning optimal coverage at competitive rates.

"I was totally lost trying to find the right mortgage insurance until I found PolicyHub. I was able to work with a licensed agent to compare all my options all at one. I got the perfect plan for me at a cheaper rate than I expected."

Barbara Winters

Policy Holder

ATTN: 2024 rates just released!

Get the latest mortgage insurance rates for 2024 and lock in your policy today! Get started comparing policies today.

Get the perfect plan with the cheapest rates in 3 easy steps.

Done in 3 easy steps

Step 1

Tell us about yourself.

Finding the perfect mortgage insurance policy starts with answering a few questions to help us serve you better.

Step 2

Compare rates & plans with a pro.

Discuss your options with a licensed insurance agent. Compare different plans to find the best policy with the cheapest rates.

Step 3

Lock in cheap rates.

Secure the lowest rates and lock in the perfect mortgage insurance policy for you and your family.

"I lost hope trying to find a mortgage insurance policy that wasn't insanely expensive. Thankfully PolicyHub helped me find the perfect policy that is affordable with high coverage. Thank you!"

Bill Barton

Policy Holder

PolicyHub is the smartest way to protect the people that matter most.

Safeguard Your Family

Mortgage insurance means safeguarding your family in a worst-case scenario. Don't risk it.

Gain Peace of Mind

Far too many Americans are financially blindsided by the death of a loved one. But not your family.

Protect Your Business

Protect your business by ensuring a smooth transition of ownership with the right mortgage insurance.

Beat Estate Taxes

Inheritance or estate taxes is burdensome for your heirs. A mortgage insurance policy can help.

Invest in Your Future

For less than $1 per day, you can make a huge contribution to your family's financial safety.

Build Your Legacy

Through a mortgage insurance policy, you can leave behind a legacy for your loved ones.

Get started in less than 5 minutes.

With PolicyHub getting started is easy. Compare all the rates from all the providers. Get started in under 5 minutes.

All your mortgage insurance needs in one place.

Private Mortgage Insurance (PMI)

PMI is your solution for buying a home with less than 20% down. It protects your lender, but also enables you to own a home sooner with less upfront cash. It's added seamlessly to your monthly mortgage payments.

FHA Mortgage Insurance Premium (MIP)

FHA's MIP is ideal for those with less-than-perfect credit scores. With an upfront premium and a smaller annual premium, MIP makes homeownership more attainable for a broad range of buyers.

USDA Mortgage Insurance

USDA Mortgage Insurance is tailored for rural homebuyers. With a manageable upfront guarantee fee and a low annual fee, it's a cost-effective way to secure your countryside dream home.

VA Funding Fee

The VA Funding Fee, unique to VA home loans, is a one-time fee that helps sustain the VA loan program for future generations of military homeowners. Depending on your service history, you may even be exempt.

"Highly HIGHLY recommend PolicyHub if you need mortage insurance. They saved me sooo much time and money on my policy, it's nuts. Comparing all the providers at once is a game changer."

Chris Stephens

Policy Holder

Introducing PolicyHub Price Match Guarantee

Our priority is to save you money while getting you the right coverage. If you find a lower rate for a similar policy anywhere else, we'll match it! With PolicyHub, you can rest assured knowing you're getting the best price.

Save time and get the best policy with the cheapest rates. Guaranteed.

|

Option 1 | Option 2 | ||

|---|---|---|---|---|

| 100% Digital | ||||

| Licensed Agents | ||||

| Expert Support | ||||

| Get Started in 5 Minutes | ||||

| Decades of Experience | ||||

| Compare 20+ Providers | ||||

| Zero Hidden Costs | ||||

| Top Insurance Providers |

"I knew I needed mortgage insurance but I didn't know where to go. I talked with a few other companies but the cost was outrageous. I found PolicyHub and found the perfect plan for me at an affordable cost."

Wendy Smith

Policy Holder

Frequent Questions...

In Marlborough, MA, mortgage insurance is an important component of home-buying and owning. It helps protect lenders and borrowers in the event that a borrower defaults on their loan. This type of insurance helps to protect lenders against loss and foreclosure in cases of default. Additionally, mortgage insurance helps to reduce monthly payments and consequently, makes homeownership more accessible for those who may need extra financial assistance. In addition to protecting lenders, mortgage insurance also safeguards borrowers by shielding them from the risk of excessive out-of-pocket expenses in case of a default.

Does the cost of a Marlborough mortgage insurance policy depend on the size of my down payment?

The cost of mortgage insurance in Marlborough, MA is typically impacted by the size of your down payment. Generally, the smaller the down payment, the higher the cost of the mortgage insurance will be. However, the greater the down payment, the less risk of financial loss for the lender in the event of default, so the cost of mortgage insurance is typically much lower. It's important to carefully consider the amount of money you plan to put down when calculating total costs associated with buying a home.

Who is eligible for a private mortgage insurance policy Marlborough?

Those living in Marlborough, MA who are interested in a home loan but do not have enough money for a 20% down payment may be eligible for private mortgage insurance (PMI). This type of insurance is usually offered to first-time homebuyers, those buying a manufactured or modular home, or those who choose to put down less than 20% of the purchase price. Eligibility criteria may vary among lenders, but generally include good credit history, a low debt-to-income ratio, and meeting all relevant legal and regulatory requirements.

How does FHA mortgage insurance near Marlborough work?

FHA mortgage insurance is an important protection for homeowners in Marlborough, MA and across the country. This insurance helps protect lenders in case of default, allowing them to offer more borrowers access to financing with lower down payment and credit score requirements. Borrowers must pay an upfront mortgage insurance premium and a monthly premium. The upfront premium is typically 1.75% of the loan amount, and the monthly premium is between 0.45 and 1.05% of the loan amount depending on the loan term.

Do Marlborough mortgage insurance companies offer USDA insurance?

USDA mortgage insurance in Marlborough, MA is a great way to provide lowto moderate-income households the opportunity to purchase property in rural areas. Part of the U.S. Department of Agriculture's (USDA) guarantees to lenders in Marlborough, MA with the purchase of rural housing, this mortgage insurance can help qualified buyers receive and maintain a loan, even when they have little to no down payment available. USDA mortgage insurance also offers competitive interest rates, meaning borrowers can save on what they pay in the long run.

In Marlborough, MA, some of the drawbacks of a VA loan include competitive pricing, limited refinance waiting periods, and private mortgage insurance. With competitive pricing, getting the best rates on a VA loan may require a higher credit score. In addition, there is typically a limited waiting period for reinvestment of the loan, which means that borrowers who want to refinance to a lower interest rate may not be able to do so. Finally, private mortgage insurance (PMI) is typically required on conventional loans but not on VA loans.

What factors influence the cost of mortgage insurance in Marlborough?

The cost of mortgage insurance in Marlborough, MA will depend on several factors such as the loan-to-value ratio, the borrower's creditworthiness, the borrower's debt-to-income ratio, and the type of loan selected. Additionally, whether there is a borrower-paid premium or lender-paid premium can also affect the cost of mortgage insurance for Marlborough, MA residents. For low down payment mortgages, the cost of the insurance will likely be higher due to the greater risk to the lender.

When does a Marlborough mortgage insurance policy go away?

The answer to when mortgage insurance goes away in Marlborough, MA depends on a variety of factors. Generally, mortgage insurance disappears once the homeowner's loan-to-value ratio (LTV) has decreased to a certain point. This can be achieved either by the homeowner making additional payments on their loan, or if the home's market value increases. Additionally, mortgage insurance changes and goes away in Marlborough, MA once you reach an loan amount payment that is below the amount set by your loan provider. It is important to note that not all lenders require mortgage insurance.

Can my Marlborough mortgage insurance company help me calculate my mortgage insurance cost?

In Marlborough, MA your lender can absolutely help you calculate your mortgage insurance. Generally, the lender will use the property information and loan amount to formulate a certain premium cost. The cost will then be discussed and agreed upon before the loan is issued. In addition to the lender providing guidance and calculation, there are a variety of online websites and calculators that can help estimate your mortgage insurance cost.

Do I need mortgage insurance companies in Marlborough?

In Marlborough, MA, mortgage insurance is not required in every case. Whether or not mortgage insurance is necessary in your situation will depend on factors such as your loan-to-value ratio, credit score, and the type of loan you have. For example, those with a loan-to-value ratio below 80% may not need to carry mortgage insurance. Consulting with a qualified financial advisor can help you determine if mortgage insurance is necessary for your individual situation.

Other locations near Marlborough, MA

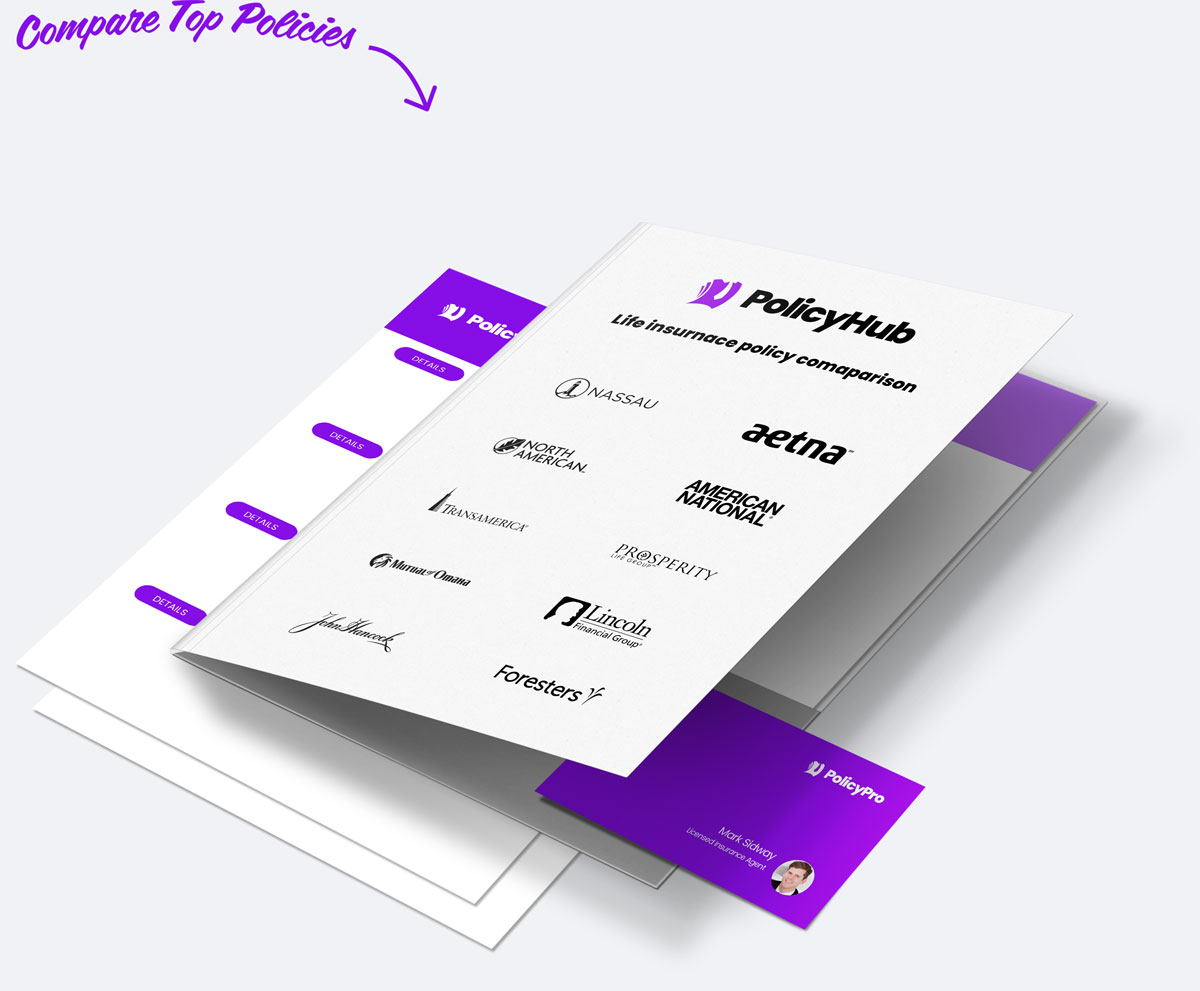

Compare Life Insurance Policies

Get started today and compare over 37 life insurance providers in as little as 15 minutes.

© 2024 PolicyHub - all rights reserved