Taking too long? Close loading screen.

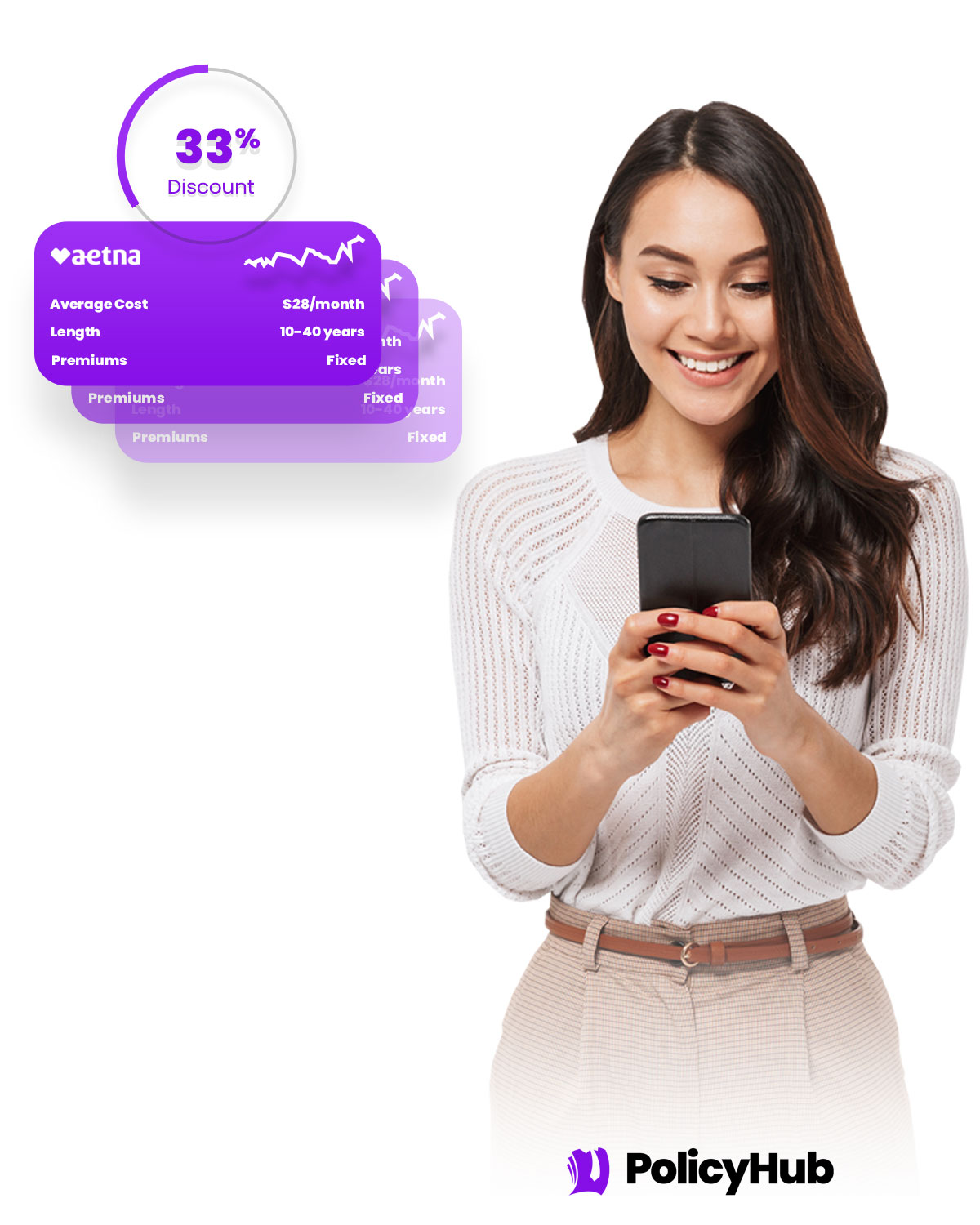

Compare over 20 mortgage insurance policies in as little as 5 minutes.

With PolicyHub you get to compare over 20 mortgage insurance policy providers in as little as 5 minutes. Save time. Save big. Get started now.

Compare over 20 top providers in Sun Village, CA

Your one-stop-shop to compare all the rates, all at once.

With PolicyHub you get:

Over 20 policy provider comparison.

Explore multiple Sun Village, CA policies from all the leading insurers and choose the one that fits your needs.

Locked in rate discount and exclusive deals.

Benefit from exclusive deals offered only to residents of your state, and lock in huge rate discounts.

Customized policies just for you.

Our team tailors policies to your unique needs, meaning optimal coverage at competitive rates.

"I was totally lost trying to find the right mortgage insurance until I found PolicyHub. I was able to work with a licensed agent to compare all my options all at one. I got the perfect plan for me at a cheaper rate than I expected."

Barbara Winters

Policy Holder

ATTN: 2024 rates just released!

Get the latest mortgage insurance rates for 2024 and lock in your policy today! Get started comparing policies today.

Get the perfect plan with the cheapest rates in 3 easy steps.

Done in 3 easy steps

Step 1

Tell us about yourself.

Finding the perfect mortgage insurance policy starts with answering a few questions to help us serve you better.

Step 2

Compare rates & plans with a pro.

Discuss your options with a licensed insurance agent. Compare different plans to find the best policy with the cheapest rates.

Step 3

Lock in cheap rates.

Secure the lowest rates and lock in the perfect mortgage insurance policy for you and your family.

"I lost hope trying to find a mortgage insurance policy that wasn't insanely expensive. Thankfully PolicyHub helped me find the perfect policy that is affordable with high coverage. Thank you!"

Bill Barton

Policy Holder

PolicyHub is the smartest way to protect the people that matter most.

Safeguard Your Family

Mortgage insurance means safeguarding your family in a worst-case scenario. Don't risk it.

Gain Peace of Mind

Far too many Americans are financially blindsided by the death of a loved one. But not your family.

Protect Your Business

Protect your business by ensuring a smooth transition of ownership with the right mortgage insurance.

Beat Estate Taxes

Inheritance or estate taxes is burdensome for your heirs. A mortgage insurance policy can help.

Invest in Your Future

For less than $1 per day, you can make a huge contribution to your family's financial safety.

Build Your Legacy

Through a mortgage insurance policy, you can leave behind a legacy for your loved ones.

Get started in less than 5 minutes.

With PolicyHub getting started is easy. Compare all the rates from all the providers. Get started in under 5 minutes.

All your mortgage insurance needs in one place.

Private Mortgage Insurance (PMI)

PMI is your solution for buying a home with less than 20% down. It protects your lender, but also enables you to own a home sooner with less upfront cash. It's added seamlessly to your monthly mortgage payments.

FHA Mortgage Insurance Premium (MIP)

FHA's MIP is ideal for those with less-than-perfect credit scores. With an upfront premium and a smaller annual premium, MIP makes homeownership more attainable for a broad range of buyers.

USDA Mortgage Insurance

USDA Mortgage Insurance is tailored for rural homebuyers. With a manageable upfront guarantee fee and a low annual fee, it's a cost-effective way to secure your countryside dream home.

VA Funding Fee

The VA Funding Fee, unique to VA home loans, is a one-time fee that helps sustain the VA loan program for future generations of military homeowners. Depending on your service history, you may even be exempt.

"Highly HIGHLY recommend PolicyHub if you need mortage insurance. They saved me sooo much time and money on my policy, it's nuts. Comparing all the providers at once is a game changer."

Chris Stephens

Policy Holder

Introducing PolicyHub Price Match Guarantee

Our priority is to save you money while getting you the right coverage. If you find a lower rate for a similar policy anywhere else, we'll match it! With PolicyHub, you can rest assured knowing you're getting the best price.

Save time and get the best policy with the cheapest rates. Guaranteed.

|

Option 1 | Option 2 | ||

|---|---|---|---|---|

| 100% Digital | ||||

| Licensed Agents | ||||

| Expert Support | ||||

| Get Started in 5 Minutes | ||||

| Decades of Experience | ||||

| Compare 20+ Providers | ||||

| Zero Hidden Costs | ||||

| Top Insurance Providers |

"I knew I needed mortgage insurance but I didn't know where to go. I talked with a few other companies but the cost was outrageous. I found PolicyHub and found the perfect plan for me at an affordable cost."

Wendy Smith

Policy Holder

Frequent Questions...

In Sun Village, CA, there are several types of mortgage insurance available. Private mortgage insurance (PMI) is a type of insurance that protects a lender if the borrower defaults on their loan. Another option is mortgage protection insurance, which pays off the mortgage if the borrower dies before repayment of the loan. Additionally, mortgage life insurance is a type of life insurance that covers the loan's balance, regardless of the underlying asset. Finally, title insurance is a type of insurance that covers the damage that results from a breach of title, such as a deed.

How does a larger down payment affect my Sun Village mortgage insurance policy cost?

A larger down payment on a mortgage in Sun Village, CA can result in substantial savings on the cost of monthly mortgage insurance. Generally speaking, the higher the down payment percentage, the lower the cost of mortgage insurance. For example, if a mortgage has been secured with a 10% down payment, monthly insurance costs are higher than those of mortgages secured with 20% or more down payments. Furthermore, buyers with higher down payments may be afforded better mortgage rates and loan terms.

Who is eligible for a private mortgage insurance policy Sun Village?

In Sun Village, CA, private mortgage insurance (PMI) may be available to potential home buyers who have less than 20% of the downpayment needed for the purchase of a home. PMI allows potential home buyers to have access to lower interest rates and favorable terms while reducing the risk for a potential mortgage lender. In order to be eligible for PMI in Sun Village, CA, the potential home buyer must have a good credit score, sufficient proof of their income, and demonstrate they are able to make monthly payments on the loan.

What are the drawbacks of FHA mortgage insurance near Sun Village?

The primary drawback of FHA mortgage insurance is that borrowers in Sun Village, CA must pay an upfront premium as well as an annual premium, which can add extra costs to your mortgage. Additionally, borrowers have to pay mortgage insurance for the life of the loan and meet specific requirements, such as having an approved credit score. These requirements, along with the costs associated with the insurance, can make getting a loan more difficult and costly that it would be with a conventional loan. In some cases, conventional loans can offer better terms for borrowers.

How do Sun Village mortgage insurance companies process USDA insurance?

Sun Village, CA residents interested in purchasing a home may benefit from a USDA mortgage that requires mortgage insurance for the life of the loan. USDA mortgage insurance works to protect the lender, and in turn the taxpayer, in the event of borrower default on the loan. The amount of the premium is based on the loan amount relative to the value of the property and the quality of the credit rating of the borrower.

The VA funding fee is a one-time fee paid to the Department of Veterans Affairs (VA) to help cover the cost of loans given to eligible veterans who would like to purchase a home in Sun Village, CA. This fee is typically 2.3% of the loan amount for first-time users of the VA loan program. The amount can vary depending on certain factors including the type of loan, veterans' status, or if it is a refinanced loan. VA funding fees can be paid by cash, check, money order, or can be included in the loan amount.

How much is mortgage insurance in Sun Village?

The cost of mortgage insurance in Sun Village, CA, varies depending on factors such as the size of the loan, number of years in the loan, type of loan, and the loan-to-value ratio. Generally speaking, the cost of mortgage insurance will be around 0.50-1.25 percent of the loan amount annually, although this number can increase or decrease based on the aforementioned factors. It is best to speak with a mortgage lender for more specific information regarding rates in Sun Village, CA.

Can I cancel my Sun Village mortgage insurance policy early?

Yes, you may be able to cancel your mortgage insurance early in Sun Village, CA. Depending on your circumstances, you may be eligible to cancel your insurance after a specified period of time. Your lender will be able to provide you with the details regarding the requirements for canceling your coverage in advance. It's possible that you could save money in the long run by taking advantage of this option. In order to do so, you'll need to carefully assess your budget and any other considerations, and discuss with your lender whether it makes financial sense to opt for cancelling your mortgage insurance early.

What factors are considered when calculating mortgage insurance for a Sun Village mortgage insurance company?

When calculating mortgage insurance in Sun Village, CA, a few key factors are taken into consideration. These include the current local interest rates, the loan-to-value ratio, the size of the loan, the loan sum, and the credit score of the borrower. Annual mortgage insurance is usually calculated using the loan-to-value ratio and the size of the loan; this determines the mortgage insurance premium and customized monthly amounts. Credit scores are taken into account to determine the borrower's ability to afford the loan and establish the mortgage insurance rate.

Can I opt out of services from mortgage insurance companies in Sun Village?

Yes, you can opt out of mortgage insurance in Sun Village, CA. As long as you meet specific eligibility requirements, you can submit a request to your lender to have mortgage insurance removed. To qualify, your loan must be at least two years old, have a current loan-to-value ratio of 80% or lower, and all payments must be up to date. Additionally, you can also remove mortgage insurance if you refinance your loan to a conventional loan, free from governmental involvement.

Compare Life Insurance Policies

Get started today and compare over 37 life insurance providers in as little as 15 minutes.

© 2024 PolicyHub - all rights reserved